As a team of researchers was asked by a French home-improvement retailer to redefine their strategy, they designed and carried out an ethnographic and quantitative research to identify new business opportunities. But no sooner had they set foot in field, they were struck not only by the richness and complexity of such ordinary activities to the point they asked themselves if these practices were even measurable? Scaling from ethnography to quantitative research was not as seamless as they expected, they had to find their way to deal with two sets of data that belong to different scales if not ontological worlds. Are these two scales really strictly separated? Can’t there be a way to combine them and to make them coincide? Based on the study of DIYing practices, this case study presents an attempt to integrate ethnographic and quantitative research and the challenge of resolving the scale differences between two methodologies. From turning DIYers into numbers and vice-versa, it explores the implications of ethnography, questionnaire design and data analysis.

Keywords: Ethnography, Mixed Methods, Statistics, Data Science, Scaling Research

INTRODUCTION

For quite a while, from the 19th century up to the mid-20th, the housing market was dominated by lumber dealers and served only building professionals. During the 1920s, this model started to be put under pressure. Types of building materials progressively replaced wood, homeownership increased and the market for mail-order expanded. Therefore, a new interest in home-improvement arose, as well as the products and services related to it. In response, some building-suppliers reconsidered their business models and introduced one-stop home-improvement stores catering to homeowners (Harris 2009a, 2012).

This model became progressively dominant as the Depression-Era in the 1930s and the WWII context spawned an increase in home improvement activity. Manufacturer of building material heavily supported this trend by promoting DIY with advertising, informational campaigns and by providing homeowners with credit to finance the purchases of building materials (Harris 2009b). It was in their interests after all. The fate of the industry was sealed in North America when social movements – such as “Build your own home” – addressed the post-WWII housing shortage by providing retailers stronger incentives to develop their distribution network (Harris 2012). In France, in addition to the technological change in building materials, conditions conducive to the development of the emerging home-improvement market gradually emerged. The encouragement of mortgage credit by the State in the 1930s and the post-war creation of social security enabled many solvent employees to become homeowners (Frouard 2012). Both in North America and Europe, one-stop shops customized for DIYers were now abounding on cities’ outskirts.

The model hasn’t changed much since then and started to decline when new players enter the home-improvement game. With the development of digital and marketplace economy, historical retailers face a major competitors outbreak, threatening their business model. From jobbers startups to GAFA, the industry value chain seems under attack on multiple points. Putting big metal boxes on cities’ outskirts, storing building materials in it and calling it a shop doesn’t attract customers anymore. Traditional retailers market shares were falling, customers were leaving.

In this context of wild competition for the favors of amateurs DIYers, a major French home-improvement franchise, ask the _unknowns research & design team to help them define a new strategy. They were not just losing market shares, they were losing the meaning of their job: were they only screwdrivers and jigsaw sellers?

For the home-improvement retailer, not only was it a necessity to set a new strategy – as they were losing market shares they needed to find new opportunities and sources of profit – defining new services beyond standard retail raised a business issue as well as an HR one. As they are selling technical building materials, they need skilled and knowledgeable in-store employees to advise customers. Such employees are hard to find, hard to keep and as the digitization of the home-improvement retail is proceeding apace, their future role remains unclear. Defining a new strategy meant tackling several challenges at the same time: building new value propositions to attract customers and redefining in-store employees’ role. Ideally, creating new services would serve both purposes. It would answer unmet needs and introduce a shift in employees’ job, from advice and sale to something-not-very-precise-else.

Whatever the outcome could be, these challenges required a deep understanding of their customers – and the retailer had to admit they didn’t’ know them very much. Categorizing customers based on their purchasing history and patterns was all they had in store. So the team had to start from the very beginning and understand what DIY is and what it means in people’s lives. Only after that, the team could bring a fresh perspective on their client, set a strategy and design useful services.

DESIGNING THE STUDY

Designing new services for the home-improvement retailer meant translating their business challenges into research challenges. Since there were several unknowns in the equation, the researchers had to be methodical and thorough. They didn’t know anything about home-improvement. So they had to uncover patterns as well as the social and cultural aspects behind such an ordinary practice. This is where ethnography plays its role. But it was not enough. They needed to scale up and assess to what extent these practices were spread in the general population. Were they marginal or widespread? Ethnography would only give intuitions but not a precise magnitude. The team had to turn toward quantitative techniques to assess where the market opportunities were located. In addition, as the results had to be quickly actionable, the home-improvement retailer would need clear and easy-to-collect criteria to segment the DIYers. And because the mission had to be carried out within a given budget and set time frame (of course), the methodology had to take project constraints into account. It had already been set that the quantitative part would be administered through an online questionnaire – which would leave little room for maneuver.

Ultimately, a two-pronged approach was designed:

- Phase I: an ethnographic study that aimed to uncover home-improvement practices,

- Phase II: a survey questionnaire administered to a representative sample of the general population that aimed to quantify the practices and DIYers characteristics identified during the ethnographic study.

Research Strategy

Given the diversity and the complexity of building materials, tools, methods and home-improvement practices, rushing headlong into the field would have resulted in leaving the team stuck, confused by the flood of technical terms and gestures. Even more, trying to make a Prévert-ish list of all home-improvement activities could have led the team into a trap. Indeed, such a list is impossible to define a priori and impossible to make in practice: a new activity could always be added to the list. More than that, setting such a list would have led the team to consider DIY in a strict and rigid way, potentially far from the DIYers’ own definition of DIY. The team tilted towards an extensive and phenomenological approach: investigate what is DIY from DIYers’ point of view and what makes them engage in doing something by themselves, in their home.

Building the Research Framework

To understand the logic of DYIng practices, the team had to take a step back to grasp DIYers and home-improvement in a broader perspective. The study was framed around several main aspects:

- The social anchors of DIY. The team’s goal was to study DIY in its environment and social contexts. Who are the DIYers in terms of social origins or positions, family structures, political and moral beliefs and inclinations? The hypothesis was that home-improvement are socially situated practices (Bourdieu 1979, Bonnette-Lucat 1991).

- The embedding of DIY. The team needed to study the social structures in which DIY takes places: the family organization with its different roles, division of labor, rules, issues, way of life and how it affects DIY itself. As most activities are embedded in wider social structures (Granovetter 1985), the hypothesis was that DIY practices are shaped by the social structure where it takes place.

- The learning logics of DIY. An emphasis was placed on observing how the skills were learned in practice. From an hand-objects systems perspective (Sigaud 2012), a special focus was put on how learnings are incorporated through practice (Wacquant 2015) considering the body both as a tool for learning and action.

The main research techniques were in-depth interviews with DIYers, combined with in-home observations of improvements and alterations already realized. The team stayed for about a day at our informants home, the interviews were carried out with the DIYers and their family. A formal interview was carried out then followed by informal discussions during the visit of their home. Given the subject and the mission’s constraint, the team estimated that meeting with 15 DIYers would be sufficient enough. The guidelines for conducting the interviews were to make an archeology of DIYing: starting the conversation with DIYers as a biography through the prism of DIY and let it slip to memorable past achievements, ongoing works and future projects. For each case, the researchers focused on action-in-the-making: how the DIYers did it by themselves. Some even went so far as to play the game of “recreating” some of their achievements. It helped to grasp the practice with details and to re-stimulate the memory of informants.

Secondly, a quantitative study was carried out using an online questionnaire administered to a representative sample (N = 1200) of the French population. The original intention was to measure the behaviours and properties of DIYers and then to extrapolate the data to the general population. The initial analysis was planned as part of descriptive and inferential statistics. The sampling and constitution of the panel was carried out by a specialised market research company. The questionnaire design and the data analysis were carried out by the _unknowns team. On paper, the quantitative part seemed relatively simple, as its articulation with the ethnographic study sounded logical at least initially. It was naive, it turned out to be a bit more complicated.

Having built their research protocol, the researchers were set to go. And no sooner had they set foot in field, they understood that DIY couldn’t be reduced to a predefined and limited set of activities.

ENCOUNTER WITH THE DIYERS: THE ETHNOGRAPHIC FIELDWORK

DIYing, Defining what DIY Is

Starting from the DIYers point of view, the researchers quickly realized that DIYing couldn’t be defined so easily. Indeed, far from being boiled down to a predetermined set of activities, defining what DIY is a part of the activity of DIYing. Each DIYer builds its own definition of DIYing both in terms of activities (such as electricity, building work, carpentry or woodworking, etc.) and the intensity with which they are practised. This tension between versatility and specialization (Bonnette-Lucat 1991) is coupled with a tension between what can be done by yourself and what can (or should) be delegated to a professional.

As a result, there is no such thing as degree 0 of DIYing. Everybody is compelled to DIY to a certain extent. It would be shameful not to change a lightbulb or build a furniture kit by one’s self. This social constraint implies taking care of a certain number of maintenance tasks by yourself and is rooted in family and intimate contexts and issues. Indeed, home-improvement practices are directly intertwined to a household’s lifestyle and ambitions. The stakes are high: the possibility for a child to play again with an accidentally broken toy, the possibility of regaining the use of the only shower in the dwelling before a week of work. All home-improvements or alterations are made in the name of a desired way of life, couple and family agreements, and constraints of (working) life. For the researchers, the word “ethnography” took on its full meaning. From the Greek “ethnos” for family, tribe, culture, ethnographying DIYers meant studying their family culture as a whole and not DIY as a disembodied practice, floating in the air like an ectoplasm.

However, DIYing practices are fragile and constantly re-assessed through action-in-the-making. At any time, the possibility of failure can arise, which calls into question the decision to DIY.

DIYing, Coping with Doubts and Fear

Uncertainty is a major component of DIYing: at any time, anything can go wrong. The DIYers’ daily challenge is to manage these doubts and find the boldness and courage of taking action. To get a feel for the DIYers challenge, one of them, Michael a 35 y.o. engineer living in Paris recalled the story of an epic fail, best known as the shower tray incident: “The shower tray is made of solid stone, 115 kg […] we laid it, we glued it, I started to lay the tiles at the same time. And during the night, I said to myself: “Uh uh, I forgot to do the levels”. The next morning, I arrive, I pour water: it was stagnant…” In the end, Mike had it changed by a professional.

The shower tray incident underlines the importance of trials and errors. Making mistakes and learning from them is an important part of DIYing. Advanced DIYers are used to make mistakes and to find ways to overcome them. Indeed, most of the knowledge and skills are built and incorporated while practicing. Having experience, using their senses and relying on them to “see”, to “know”, and of course to “feel” while in action, is at the heart of DIY. There is no substitute for experience, not even a good handbook. And getting experience requires trying, i.e. self-confidence, a sense of authority beyond intellectual and manual skills. Thus, the ability to deal with doubt, fear and incidents is what most differentiates DIYers as well as their proclivity to engage in diverse activities and to learn by themselves.

4 DIYers Profiles Uncovered

The research team observed four different DIY profiles, based on their attitudes dealing with doubts and fear, playing around with tools, and building materials.

- Compelled DIYers. They only tend to do small maintenance work by themselves such as minor repairs, building furniture kit, etc. Their home-improvement practices are driven by social constraints. Some even have chosen their house because no work needed to be done. Michel, a bachelor in Clermont-Ferrand said to the team: “the apartment was in this state, I didn’t redo the wallpaper, it was generally quite clean, so it was a stroke of luck! […] I do the minimum, I know how to drive a nail to put a frame, but I have no interest”. What prevent them to engage in DIYing was they don’t have enough resources (skills, sense of authority, incorporated knowledge) to take action and overcome their fear and feeling of incompetence.

- Hobbyist DIYers. They carry out maintenance and repair tasks to comply with their obligations, but they also invest in some specialized activities as a hobby. Not all DIY activities are eligible to become a hobby, this mainly concerns the creation or repair of furniture, gardening, car repairs, and all sorts of activities that don’t impact on the family lifestyle nor the usage of an important home feature (such as the shower). In some of these activities, DIYers can even compete with professional craftspeople.

- Self-Sufficient DIYers. They tend to great versatility and expertise. They engage in DIY activities with an ideological dimension: DIY is a valorization of autonomy, resourcefulness and individual responsibility. They value the fact that they are not dependent on anyone, sometimes to the point of challenging professionals. Mark, a 38 y.o. living with his wife and a 2 y.o. baby told the team: “I’ve laid steel-pan roofing, I’ve done roofing before. I could even do whole roofs. Honestly, […] if I had a job that would allow me to take a year off, you know, to be out of work… if I had a job that would allow me to do that, I could build my house by myself”. In addition, they do not hesitate to tackle home-improvement issues that could impact the family lifestyle.

- Semi-professional DIYers. This profile is a continuation of the self-sufficient DIYers to the point where it may be considered turning DIY into a profession: putting themselves at the service of something other than a housing ambition, as Franck, a 43 y.o. engineer turned entrepreneur: “The apartment I buy it partly to rent it… that is the difference, it is important. Typically, I don’t have nice furniture, I bought furniture from Emmaüs [local charity] […] this summer, we removed some cables to be able to insulate the oven […] and put a specific circuit breaker for the plates, in 32A, because they were in 20A […] I brought the electricity up to standard, because that was dangerous, and in terms of… When you’re renting, you’d better… make sure everything is up to standard as much as possible”.

The purchased-patterns home-improvement retailer customer segmentation was surely challenged. But was it enough to make it shift? Seeing these results, the home-improvement retailers executives empathize with different types of DIYers and their everyday challenges, some even recognize themselves among the profiles presented. Ethnography surely demonstrated its interest to reveal the logics behind the practices, but a concern quickly arose. Could these findings be quantified? Indeed, even if these insights could fuel the design process to imagine new services, it was not enough to identify where the business opportunities were located – if it was in their interest in specifically targeting one or more of the DIYers profiles. The strategy couldn’t be defined yet, we were still in the middle of the fold. This is where the numbers come in.

HOW DIYERS CAN BE TURNED INTO NUMBERS: SCALING THE RESEARCH

The quantitative part was where the plot thickened. Measuring DIYing behaviours turned out to be slightly more complicated than initially expected. Indeed, it implied matching two scales of analysis of a different nature.

Two Scales of a Different Nature

When the team started to design the questionnaire at the beginning of the quantitative phase, several problems arose. Indeed, ethnographic materials and quantitative-questionnaire data are not easy to connect. Each one has its own scale, properties and captures different aspects of reality.

As ethnography captures various kinds of traces – audio, transcription, pictures, diagrams, drawings, gestures but also field notes that reflect the lay of the land – its research unit is multifaceted and diffuse. Indeed, the ethnography grasped the complex DIYers’ experience intertwined within the symbolic and material reality of their home and family. DIYers were not alone, they had spouses or wife, children and all the family participated in home-improvement to a certain point. The ethnography captured not only the DIYers experience of DIY but a part of their tribe’s experience in situations.

On its side, quantitative-questionnaire captures standardized answers to a predefined set of questions but provides little information on context – especially when administered online. Thus, its research unit is unitary and discontinuous: a series of context-blind individuals reactions to the questionnaire. The research team was aware that an online questionnaire would only provide artifacts generated by the questionnaire itself.

Do ethnography and quantitative questionnaires belong to two different and irreducible knowledge scales? Realizing these differences, it seemed to the team that no direct and continuous link could be established between these two scales. The researchers wonder if they could really quantify their ethnographic finding with an online questionnaire. They felt they were trying to fit a square peg in a round hole. If it was the case, it would have meant that it was impossible to quantify ethnographic findings. And the team would have been in a good mess! But there is only one real world, and multiple ways of describing and understanding it. Ethnography and quantitative questionnaires can only extract traces from this real world – different kind of traces. And the diffuse nature of ethnographic traces should be approximated through a standardized questionnaire. The researchers were facing the same doubt the DIYers had to go through. They decided to give it a try and started thinking by putting themselves in their informants shoes: what would they answer if they were confronted with this questionnaire?

Designing the Questionnaire: Translating Ethnography

The behaviors observed by the ethnography could not be directly measured by a questionnaire. But a questionnaire could capture specific and revealing information about behaviors or attitudes observed in the field. In a word, the questionnaire could provide approximations and hints that would need to be interpreted and combined to make sense of its data. The researchers thus designed each question – or group of questions – as a test to provide specific information on DIY practices. And in order not to be completely off the mark, it was necessary to start from the concrete reality of DIYers, i.e. ethnography.

Thus, ethnography was a valuable resource for questionnaire design. The team focused on translating the ethnographic findings into testable hypotheses within the questionnaire. The idea was to identify items or groups of items whose responses would most differentiate DIYers – well, according to the ethnographic study. To verify the existence and relevance of the profiles identified, the team gradually designed specific tests to assess DIYers profiles, their attitudes when facing doubt, their practices or their arbitrations. To achieve phrasing relevant questions required to look for details in the ethnographic material that would have remained left out otherwise. The team needed to plunge back into the interviews to analyse in detail all the activities (electricity, plumbery, building work, carpentry and woodworking, etc.), their underlying culture, vocabulary, tasks, tools and gestures.

Getting into the DIYers’ shoes: that was the team’s approach. 1) Use the lessons of the ethnographic study to make hypotheses (how to identify this profile knowing this?), 2) translate them into sufficiently sensitive and specific tests, and 3) use the richness and depth of the ethnographic material collected to find the most precise and relevant items and formulations. The researchers felt there was no such thing as a one-best-way to design the questionnaire. They tested it themselves and had it tested by other members of the unknowns team in order to assess whether the questions were unequivocally understood and to get an idea of what the results could be. It was more a case for trials and errors than a deterministic science: they DIYed.

The questionnaire was administered to a representative sample of the French population. 1,200 responses were collected in the end. At this point, the researchers didn’t really know what to expect, they were not at the end of their surprises.

HOW NUMBERS CAN BE TURNED INTO DIYERS: JUGGLING WITH SCALES IN PRACTICE

When the results came back, the team started to perform an exploratory data analysis using dimensionality reduction and clustering techniques in order to verify – among other things – if the DIYers profiles identified during the ethnographic fieldwork could be found in the quantitative data.

Spoiler alert: the team faced unexpected results. On the one hand they didn’t find the exact same profiles as identified in the ethnographic fieldwork, on the other hand data analysis also led to some good surprises.

Looking for the DIYers

While filling the questionnaire, respondents were asked to report for about 40 DIY activities – of different types, issues, and levels of difficulty – whether or not they had been carried out in their dwelling and by whom (by themselves or delegated to someone else: partner, relative or professional). The underlying hypothesis came from what the ethnographic study had revealed: that Compelled DIYers only did maintenance tasks, that Hobbyists DIYers invested in a few activities without stakes, that Self-sufficient DIYers were not afraid to engage in many types of work by themselves even with high stakes. Finally, the Semi-professional DIYers tackled all types of tasks, no matter how difficult they were. Thus, each type of DIYers should have had a particular profile of response.

To cross validate their results, the researchers ran two types of clustering techniques – Kmeans and Hierarchical Classification on Principal Components (HCPC) – after a dimensionality reduction – Multiple Component Analysis (MCA). The algorithms were running, drum roll… and three groups came out on the first draft. The team felt disappointed, if not frightened. Things seemed to go wrong.

Before plunging into the intricacies of data analysis, side note: for those who aren’t familiar with Euclidean distances, minimizing inertia methods and other mathematical matters HCPC iteratively builds a hierarchical tree (the so called dendrogram) by coupling two by two the closest measures in pairs and then repeating the operation, this time coupling the closest pairs. At the end, it results in a tree whose different branches partition the data into several groups. HCPC algorithms usually suggest the smallest number of ramifications to take into account by isolating the branches with the smallest variance.

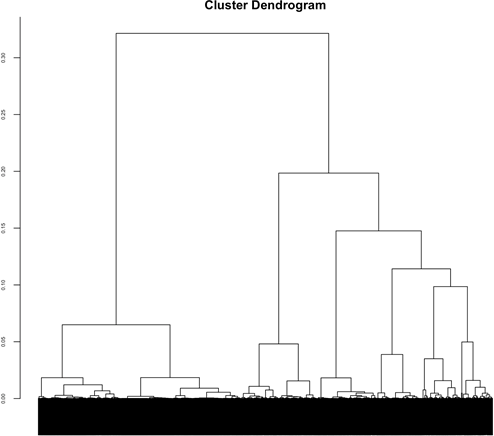

The researchers analyzed the hierarchical tree provided by the HCPC and there was no reason whatsoever to think there were four clear distinct groups. In fact it was even questionable to be able to clearly distinguish groups.

Figure 1. Hierarchical tree built by the HCPC algorithm ©Guillaume Montagu

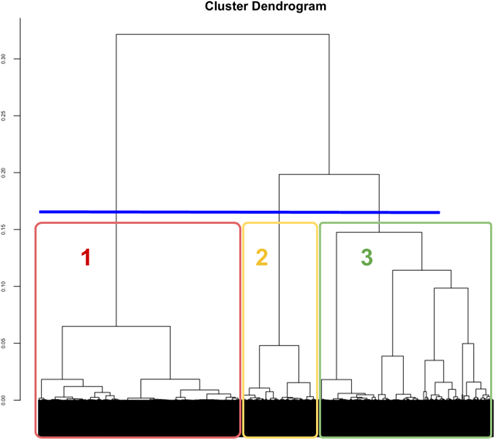

So the algorithm suggested three groups. Even if the researchers found that disappointing, they decided to give a chance to the machine. They looked into the data in detail and the results appeared to be even worse than expected: the groupings made by the algorithm were unclear and remained difficult to interpret. The first group seemed consistent and could match the Compelled DIYers profile previously identified, but the two others seemed to be muddled and heterogenous. That’s how the researchers got a feel for the DIYers’ experience with uncertainty.

Figure 2. First hierarchical tree and cut section suggested by the algorithm that separate the tree in three groups ©Guillaume Montagu

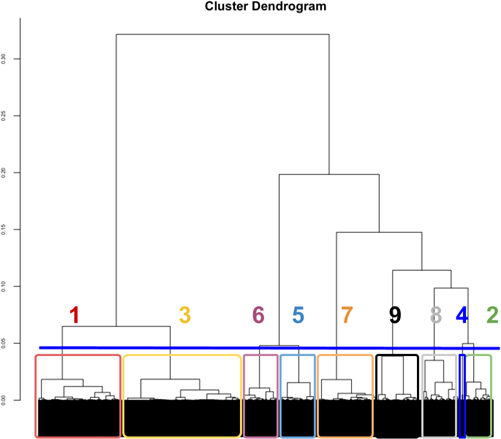

Experiencing this dead-end, the team had to find a way to get out of this impasse. In an act of despair they decided to consider lower branches of the three. They looked at a finer level of details and considered four groups. But still, the possible interpretations of the groupings remained unclear. Without really believing in it, the team continued to descend the tree. It was only by considering nine groups that the results became clearer. The groups composed by the algorithm made more sense and, fortunately, the team found the characteristics identified in the ethnographic part.

Figure 3. The same hierarchical tree with the cut section selected by the research team, it divides the data in nine groups ©Guillaume Montagu

- Groups 1, 2, 3 & 4 looked like the profile of Compelled DIYers: they stick to maintenance tasks (with some little variations). They seemed to easily give up on DIYing or getting work done. What differentiated the groups are the kind of activities delegated to professionals – usually “big” works (group 2 & 4).

- Groups 5, 6 & 9 looked like the profile of Hobbyist DIYers: beyond maintenance tasks some activities were particularly invested in, especially gardening, auto repairing, decorating, furniture repairing/building – i.e. activities that don’t impact the family everyday lifestyle. Other “big” works were usually delegated to professionals. One interesting thing: group 5 looked more like they were spouses of Hobbyist DIYers, the activities beyond maintenance tasks were invested by their partner.

- Groups 7 & 8 looked like the profile of Self-sufficient DIYers: most activities were invested in whatever the complexity or importance, including technical activities such as electricity, plumbery, roofing or levelling. Another interesting thing: group 7 looked like they were spouses of Self-Sufficient DIYers. Most of the activities and especially the “big” and technical ones were invested by their partner.

- But no clear traces of the Semi-professional DIYers at this point… Some converging hints make the team think that they were hiding in groups 7 & 8 but without enough evidence to isolate them as a distinct group from the Self-sufficient DIYers.

Why did the algorithm fail to suggest meaningful groups? The problem relied on a tacit assumption during the questionnaire design. Designing the questionnaire led the team to normalize behaviours into comparable variables. Thus, all activities were considered equivalent and comparable on the same basis. And that’s exactly what the algorithm did: it attributed the same “weight” to all the variables – which is disputable. How can carpentry activities be compared on the same basis with plumbery or leveling ones? The variable couldn’t be “weighted” properly to be read without bias by the algorithm. Then all the suggestions and predictions based on the inertia-minimizing criterion were not completely reliable. The algorithm did well in gathering the answers that looked alike, but did not properly identify the boundaries between groups. That was a task that could only belong to a human eye.

Retracing the Tribes

For a moment the researchers forgot that they were interrogating individuals and not tribes anymore – as they were doing in the ethnographic part. Indeed, a “tribe” answering a questionnaire does not make sense but a member of a tribe does. And it was obvious that different kinds of “tribe” members would answer the questionnaire, especially when the sample had been drawn from the general population. Here again, the team was not operating on the same scale that what was identified first in the ethnographic material: DIYers profiles were DIYer-tribes profiles instead.

Seeing things from this perspective allowed the team to “see” the tribes in the data, beyond individual answers. It brought out a mosaic aspect of the reality of DIYers and their families. The DIYers tribes couldn’t be quantified “as tribes”, it was only possible to collect data from their members. Thus, the team had to reconcile this data in order to interpret it. Thus, the DIYers-tribe clusters were made on this basis and deviated from what the HCPC algorithm originally suggested.

However, the classification algorithm made it possible to highlight aspects that remained unnoticed during the ethnographic study. In particular, it was able to highlight a clear dividing line between the Compelled DIYers and the other profiles. Putting aside maintenance tasks, it became obvious and objectified that Hobbyist DIYers and Self-sufficient DIYers do more work in general in their dwelling than compelled DIYers – by themselves or by delegating it to professionals. Seeing that Hobbyist DIYers were getting significantly more work done in their homes, a new hypothesis emerged: practice begets practice, the more you DIY, the more you transform your home, by yourself or not.

But confirming and consolidating the findings of the ethnographic study was not the only goal of the quantitative part. Since the analysis was performed on a representative sample of the population, it was possible to infer the likely shares in the general population and thus the market size represented by each profile.

WHERE KNOWING DIYERS INSPIRES STRATEGY & DESIGN

In the end, the team was not only able to draw a new customer segmentation and a strategy, they did even more. They progressively built a common knowledge, shared with the French home- improvement retailer, along this journey through different scales of analysis.

When the results of the ethnographic survey were shared, it was like an epiphany for the client. Some of the sponsors projected themselves into the results to the point of recognizing themselves in the profiles identified. It helped them to empathize with DIYers as well as understand the logic behind the practices. They knew the DIYers better and it also created a common will to challenge their existing metrics and ways to consider their customers. And this combination of scales shed a light on different aspects of their customers that they weren’t aware of.

Once this knowledge base was shared, several strategic scenarios came naturally with the home-improvement retailer ending up with a reappraisal of their role in DIYers life. As a new customer segmentation arose, the question was which profiles should be targeted and how could they be targeted. This new knowledge base has irrigated all strategic work from there: on the offer, the partnerships, the distribution network, marketing, the store concept and so on.

But there was one part on which the team continued to work on. A part of the new strategy specifically addressed the Compelled DIYers. The idea was to help them to take action and launch their projects (on their own or by delegating them to a professional). The team continued the work to design a service to tackle this challenge, with the retailer employees. The knowledge built during the mission continued to be shared within the organization. A proof of concept was designed and tested at small scale in real life in five stores. Progressively, the new customer segmentation infused the home-improvement retailer culture, processes and helped them to deliver a meaningful service. As long as DIYers have to face doubts and uncertainty, there will be a need for empathy and support beyond cheaper one-day delivered building materials.

NOTES

Acknowledgements – The _unknowns team involved in the project: Ines Bel Hadj Amor, Chloé Huie Brickert, Henri Jeantet, & David Marti.

Francesco Madrissotti for being such a great ethnographic sleuth and sparring partner.

All the DIYers and their family met during this fieldwork.

Chloé Huie Brickert & Elena O’Curry for proofreading and insightful comments-making.

1. In 2012, more than 60% of French people own their own home, compared to 35% in 1954.

2. Multiple Component Analysis (MCA) was used as dimensionality reduction technique and then Hierarchical Clustering on Principal Components (HCPC) was used and crossed validated with Kmeans. All the data analysis was carried out with R and the package FactoMineR.

REFERENCES

Becker H. S., 1998, Tricks of the Trade: How to Think about Your Research While You’re Doing It, Chicago, Ill., University of Chicago Press

Benson, M., & Hamiduddin, I., 2017, Self-build homes: Social values and the lived experience of housing in practice. In Benson M. & Hamiduddin I. (Eds.), Self-Build Homes: Social Discourse, Experiences and Directions (pp. 1-14). London: UCL Press

Bonnette-Lucat C., 1991, “Les bricoleurs : entre polyvalence et spécialisation”, Sociétés Contemporaines, n°8, 1991, p. 61-85

Bourdieu P., 1979, La distinction, critique sociale du jugement, Paris, Minuit.

Clogg C., 1992, “The Impact of Sociological Methodology on Statistical Methodology”, Statistical Science, vol. 7, n° 2, pp. 183-207

Daynes S. & Williams T., 2018, On Ethnography. Cambridge (UK), Polity Press

Desrosières A., 2001, “Entre réalisme métrologique et conventions d’équivalence : les ambiguïtés de la sociologie quantitative”, Genèses, n°43, p. 112-127

Frouard, H., 2012, “Tous propriétaires ? Les débuts de l’accession sociale à la propriété”, Le Mouvement Social, 239(2), 113-128. doi:10.3917/lms.239.0113.

Glaser B. G. & Strauss A. L., 1973 The Discovery of Grounded Theory: Strategies for Qualitative Research, Chicago, Ill., Eldin

Granovetter M., 1985, Economic Action and Social Structure: The Problem of Embeddedness, American Journal of Sociology 1985 91:3, 481-510.

Harris R., 2009a, “The Birth of the North American Home Improvement Store, 1905-1929”, Enterprise and Society 10,4, 687-728, doi: 10.1093/es/khp017

Harris R., 2009b, “The birth of the housing consumer in the United States, 1918–1960”, International Journal of Consumer Studies, 33: 525-532, doi:10.1111/j.1470-6431.2009.00797.x

Harris R., 2012, Building a Market: The Rise of the Home Improvement Industry, 1914-1960, Chicago, University of Chicago Press,

Ladner S., 2014, Practical ethnography : a guide to doing ethnography in the private sector, Walnut Creek, CA, Left Coast Press

Ladner S., 2019, Mixed Methods: A short guide to applied mixed methods research

Sampson O., 2018, “Just Add Water: Lessons Learned from Mixing Data Science and Design Research Methods to Improve Customer Service”, Ethnographic Praxis in Industry Conference Proceedings, (1):646-662, doi: 10.1111/1559-8918.2018.01227

Sigaut F., 2012, Comment Homo devint faber. Comment l’outil fit l’homme, Paris, CNRS Éditions,

Stevens, S. S., 1946, “On the Theory of Scales of Measurement”, Science, 103, doi:10.1126/science.103.2684.677

Tilche A. and Simpson E., 2017, “On trusting ethnography: serendipity and the reflexive return to the fields of Gujarat”, Journal of the Royal Anthropological Institute, 23, 4, p. 690-708 doi: 10.1111/1467-9655.12695

Wacquant L., 2015, For a Sociology of Flesh and Blood. Qual Sociol 38, 1–11, https://doi.org/10.1007/s11133-014-9291-y