The aim of this paper is to explore the potential for ethnographic approaches in technology startups and the venture capital firms that support and control them. The current practices and model of innovation aim for “disruptive innovation,” but most efforts fall short, prioritizing mass diffusion and not focusing on where true disruptive innovation lies—creating a change in meaning. I argue that an ethnographic approach can lead to innovation of meanings, bridging the gap between radical innovation and diffusion, and creating disruptive innovation. I discuss some ways ethnography can help product innovation in the startup sphere. But, more importantly, I discuss how ethnography holds great potential for reshaping the VC field, by driving meaning into the VC I then highlight alternative viewpoints that move beyond the “realist” perspective.

Keywords: Innovation, Technology, New Product Development, Finance

INTRODUCTION

Over the last twenty years, ethnographic research has played a growing role in innovation research, but by and large, that role has been centered in the realm of corporate innovation. The dominant ‘folk model’ focuses on ethnographic research employed to identify new product opportunities and realign corporate strategies. But the world of ‘innovation’ is much broader with different potential for engaging ethnographic approaches. One of the most fruitful realms for research supporting innovation would seem to be in technology startups, and yet the startup world seems to be generally unaware of the potential of ethnographic approaches.

I have conducted research on tech startups in different parts of the globe over the past few years, with a particular focus on practices within startups, their spread, and their impact on innovation. A main contribution of this research has been investigating how recent changes in technological capabilities, practices, and structures have impacted innovation. The process of innovation as it has been conceived historically consists of three general, yet overlapping phases: invention -> innovation (use) -> diffusion (King et al. 1994). But the model of innovation being spread in startups today is now shifting to an orientation where diffusion precedes the actual ‘innovation.’ The methods employed, which emerge from the doctrines of Lean Startup and Customer Development, focus on the possibility of mass diffusion and easy adoption before anything is ever created. And, notably, the model of funding rewards those startups with this aim. I argue that this bias towards diffusion limits the tech startup landscape from developing more powerful innovations. It precludes investment in innovations that focus on localized problems, that aim for sustainable growth, that serve marginalized users, or that solve wicked, knotty problems. And, counter to common claims, it limits the possibility for truly disruptive innovations, which by definition take time to diffuse.

This paper explores the potential for ethnographic approaches to support innovation in the global tech startup scene– in startups themselves, but, more importantly, in the venture capital firms that have the capacity to fund and thus drive much of startup innovation. To some extent, “design thinking” approaches have begun to be integrated into some startups’ approaches, but by and large, ethnographic research is not known or understood within the startup world. Much in the same vein as the corporate ‘folk model,’ ethnographic research could help find new paths within seed-stage, early-stage, and growth-stage startups. In seed stage, it could enable a greater localized understanding of the context or problem space in which a product is being created and provide deeper data to base decisions on than just click-metrics. For other early-stage startups who have created a technological innovation without a clear market in mind, such research has implications for the product aims and the user groups that are focused on, which could be particularly valuable for smaller, marginalized, or otherwise neglected groups. And beyond, in growth-stage, ethnographic approaches can help in adapting successful solutions or new technologies to other markets. The potential is great, but the challenge is how startups access such resources or develop necessary skills.

A more promising area for impact, and one that has the resources for such research endeavors is in the venture capital firms that identify trends, scout startups, and invest in them. Venture capitalists make many small bets among the startups they select, with the goal of having at least one team among many become successful. The goal is to foster a portfolio that produces large capital gains within a timeframe of less than 10 years. In practice, this promotes funding of globally-focused, scalable, profitable ideas. Many founders start with the goal of solving a problem but in order to garner investment, they must prioritize diffusion. And most will fail. Rather than functioning as scouts for the next one-in-a-million globally-dominant product, venture funding could refocus on a more organized, systematic approach that incorporates research focused on anticipating trends and understanding the contexts of different markets through research. Such ethnographic research could reorient the focus to supporting more sustainable, truly innovative startups. In short, innovating the process would in turn foster more innovative products.

The role of ethnographic methods, however, is indeed not simply to provide insights into a new realm to “colonize.” I aim to highlight the potential for research in innovation to focus on more on navigating complexity, attuning startups and venture capitalists that fund them to the values and contexts surrounding their products, advocating for different user groups, and anticipating change.

SHIFTING FLOWS OF INNOVATION

Aiming for Disruption

Innovation is defined in different ways depending on the context and the author. At its most basic level, innovation refers to newness in form or approach (Van de Ven 1986). There have been countless studies of innovation, viewing the concept both from a product perspective (the innovative outcome or result) and from a process perspective (how one innovates) (Bundy 2002). Here, I want to unpack the two more closely.

From a product, or result, perspective, there are many types of innovation, discussed along a variety of spectra. But the most discussed and frequently debated conceptualization of innovation in the current technology sphere is disruptive innovation — those innovations that disrupt an existing market or displace an earlier technology. Though the phrase disruptive innovation was coined by Clayton Christensen in the mid-1990’s (Christensen 2013), the concept of innovation through ‘creative destruction’ was first popularized through economist Joseph Schumpeter’s theories from the 1940s (Schumpeter 2013). Schumpeter described this ‘revolution from within’ as an inherent part of innovation. In today’s startup sphere, this focus on disruption is very much considered the ideal. I will note here that much research has noted the dangers and downfalls of a focus on disruption, and, more broadly, that innovation does not mean the changes it creates are necessary or positive (Abrahamson 1991). I will take up these issues again later. What is important here is that disruptive innovation is currently a main goal for startup founders and the venture capitalists who fund them alike. According to Paul Graham, founder of Y Combinator, startup ideas should be risky and actually even repel you (Graham 2012). There is a pervasive attitude that startups should be disruptive, contrarian. This focus foregrounds all that follows.

This focus on disruption, then, creates a central challenge for the startup community writ large. The startup sphere has a tendency to aim for innovations that will have a revolutionary impact to the market — disruptive innovations — but at the same time, many of the innovation processes emphasize iterative, small feedback loops to refine ideas and products, based on feedback from those who would use the product– early adopters. This creates a sort of dichotomy of focus on revolution and evolution from the outset. I frame this dichotomy in terms of Norman and Verganti’s (2012) discussion of radical versus incremental innovation. By their definition, radical innovation is “a change of frame (‘doing what we did not do before’),” while incremental innovation is “improvements within a given frame of solutions (‘doing better what we already do’).” Norman and Verganti argue that radical innovation is “surprisingly rare” and requires agents of meaning or technology change (2012, p. 6). In their point of view, most innovation is incremental. And this is indeed what I have witnessed in the startup community.

A Focus on Diffusion

Over the past few years, I conducted an in-depth research of technology startups and startup accelerators situated in different locations globally. Much of this research was conducted in situ through ethnographic fieldwork within Silicon Valley and over the several-month courses of accelerator programs in Singapore and Buenos Aires. This provided a rich view into the day-to-day workings of these accelerators and those affiliated with them– founders, funders, mentors, and more. Additionally, I have conducted interviews in Silicon Valley and abroad with a variety of people playing various roles in the startup community. Through this, I have learned the processes and practices of Silicon Valley and global startups—how they innovate. And what I have witnessed is a counterintuitive focus on disruption and diffusion simultaneously.

The process of innovation as it has been conceived historically consists of three general, yet overlapping phases: invention -> innovation (use) -> diffusion (King et al. 1994). There are many approaches from a variety of schools of thought on the flows and influences of innovation that critique such a linear approach and present other approaches, but diffusion is always considered to occur late in the process. I argue that the model of innovation being spread since late 2000’s has shifted that flow, making it looped or even backwards. And by way of the global reach and connectedness of the tech startup community and certain funding mechanisms, this is fundamentally changing the flow of innovation from one that begins with an invention or product to one that begins with a focus on global diffusion. And this inherently changes the types of “innovations” that make it the market.

In the first dotcom boom in the late 1990s, it was very expensive to build a software product. Startups had to have an initial product or an idea that seemed really good. Then they would get investment a priori to build it or to continue building it. With funding, they would then build it and then see how well it diffused. Today, it is cheap to build software, so you can easily start to develop something. But now, in order to get funding, you have to show how it would scale, not just guess how it would. Metrics showing traction and validation are key. This focus is oriented by the Lean Startup model and Customer Development practices, which rely on several concepts that originate from Rogers’ work on diffusion of innovations (DOI).

In Lean, an MVP need not be a functioning product. It can, and often is, still in the idea phase. As Steve Blank, the creator of Customer Development says: “You’re selling the vision.” The idea or experiment is tested with “early adopters,” a phrase coined in Rogers’ DOI work. Validation of the idea relies on tracking metrics and creating a “funnel” of potential customers. The goal is to exhibit the ability to “Cross the chasm,” i.e. move from early adopters to the mainstream market— which is based on the graphical depiction of innovation diffusion over time in Rogers’s work.

This is not the same as going out and researching a market to develop a product. The focus, rather, is on evaluating whether the product will scale before actually fully developing it. The process moves from finding potential early-adopter customers for an idea, to refining that idea based on how they may use the product, to then developing the actual product. The potential for diffusion precedes the innovation.

This flow was not possible until recent years. First, the global, networked platform of the internet has enabled software and digital products to be globally scalable. Secondly, recent technological advances underlie the ability to measure global scalability. One can now test an idea and analyze data in ways previously not possible. Analytics tools like KISSMetrics, Mixpanel, and Google Analytics enable the development of measures to determine demand and scalability. Advertising platforms like Google AdWords and social networking sites like Facebook provide methods to experiment. And the models of Lean and of Customer Development provide the structure to follow. Teams can start with a premise or an assumption of a problem and create advertisements on Facebook or Google AdWords to target potential customers. They can then measure their interest directly based off of clicks and conversion rates and other metrics, all before committing a single line of code in the product.

The common conception of ‘startups’, the canonical literature in this area, and adoption of Lean methods and principles are all products of Silicon Valley. The terminologies and cultural views of this origin are imbued into the structures, practices, and approaches — and this includes adoption of the venture capitalist business model and its underlying goals and objectives. While VCs provide value to the innovation teams by injecting economic capital, VC funds also rely on (and expect) a return of capital via increased valuation and a future liquidity event, commonly known as an “exit.” This enables the VC to provide returns and to fund its future operations. It is a hit business; it makes many small bets with the goal of having at least one team among many become successful. Therefore, by design, the goal of VC operators is to foster an environment that produces large capital gains within a short timeframe. In practice, this translates into a culture within the startup world that promotes creation of globally-focused, scalable, and profitable businesses. It privileges global scalability (diffusion) over what the actual technology is or how it is used.

Seed-stage and early-stage startups are trying to create a product and create a business simultaneously. They are focused on doing something innovative, but also on building legitimacy and showing that they are scalable. Their survival relies on funding, and funding is rooted in both of these. They have to show investors they are building something scalable and have metrics to prove it. They also have to appear legitimate, participating in the culture and practices that are part a startup world. The incentives for mass diffusion shape the direction of the product more than developing an innovative or useful product do. Even if that is not the goal in the beginning, startups often reorient to garner continued investment from their funders, who become their advisors.

Placing the focus a priori and continuously on diffusion fundamentally shapes the types of innovations that are made. Namely, it shapes the focus toward designing technologies that are easily adopted, and that would be adopted broadly. This may influence focusing on broader problems that effect many people. It may also promote the development of products with immediate impact, which can then be built upon, contributing to cumulative innovation (Murray & O’Mahony 2007). But, prioritizing for potential diffusion, but not for radical change, notably also limits the possibility for disruptive innovation.

While many in the startup community—both founders and funders—tout a focus on disruptive innovation, the structure they provide is counter to promoting disruption in a number of ways. Lean is focused on incremental improvements, not bold changes and ideas. Customer Development emphasizes testing and refinement with early adopters, not those that would be “disrupted” typically. And ideas get funded based on metrics and a model that proves rapid scalability. Disruptive technologies are, by nature, not rapidly scalable. Because they are disrupting something that was stable, it takes time for them to diffuse.

Reorienting Through Meaning

In their analysis of radical and incremental innovation, Norman and Verganti present some frameworks to evaluate the relationship between the two. In doing so, they break down innovation into two dimensions: technology change and meaning change. In one framework, they map these two dimensions to incremental and radical change, illustrating how these connect to what they consider the drivers of innovation: technology, design, and users. In a second framework, they then link these types of innovation to the role of research, building upon concepts from Donald Stokes’s work on Pasteur’s Quadrant. They characterize their quadrant in terms of the “quest for a novel interpretation of meaning” and the “quest for practicality.” The resulting analysis highlights roles of research in each of the four quadrants.

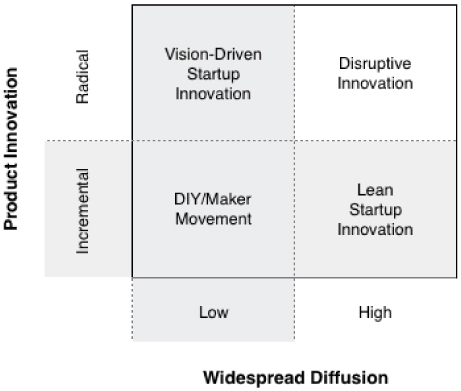

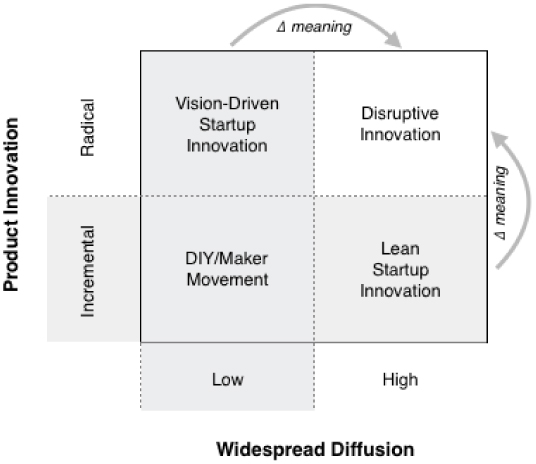

Taking this framework as inspiration, I have applied similar thinking to the types of innovation in startups— from both product and process perspective. I connect the type of product innovation change with the innovation process focus on diffusion (Figure 1). The product dimension, on the Y axis, focuses on the degree of change: low is incremental, high is radical. The process dimension, on the X axis, shows the degree of widespread diffusion—low or high. This yields four quadrants, illustrating four types of startup innovation: the do-it-yourself (DIY) or maker movement innovation, Lean Startup innovation, vision-driven startup innovation, and disruptive innovation. I briefly explain them below, but will delve into more detail regarding the three main quadrants of interest in the next section.

- DIY or maker movement innovation. Innovation in this quadrant for the most part is incremental, building on technologies that already exist, and by nature, DIY products are not intended to be widely diffused. While this is an interesting and important emerging area of innovation, it is not generally relevant to the types of scalable startups I will be discussing through the rest of this paper. As such, I briefly mention it here, but will not go into further depth.

- Lean Startup innovation. This quadrant is where the majority of startups I have studied lie. For reasons related to funding, which I will delve into in more detail later in this paper, they focus heavily on diffusion a priori. And while many, if not most of these startups profess to aim for disruptive innovation, the nature of the Lean process is such that they must focus on incremental change.

- Vision-driven startup innovation. This quadrant if where a much smaller minority of startups are situated. Chief among them are startups who have a strong vision they are pursuing, without following processes like Lean and Customer Development, or teams that have developed a new technology, but are unsure what it can be used for more broadly.

- Disruptive innovation. This is the quadrant that the most successful startups reach. They have created a radical change through technology or meaning, and that change has been adopted and diffused widely.

While I have separated these into rather discrete categories here for the purposes of defining them, they are most certainly not separate, mutually-exclusive categories for startups. Rather, they are spectra along which types of startups can loosely be pinned at one point or another. But, importantly, movement within these dimensions is fluid and malleable. That is to say, it is entirely possible that a Lean-focused startup or a vision-driven one could ultimately become disruptive. What it depends upon, as Norman and Verganti explain at length in their paradigm, is a change in meaning.

In their analysis of different approaches to design research, the authors argue most forcefully for the power of design-driven research to enable radical innovation through “envisioning new meanings that are intended to be applied in products” (2014, p. 29) And the study they provide as their grand example is one aimed at creating new knowledge about meanings of kitchen products. While advocating broadly for this focus on meaning, they also readily admit that, as an approach to innovation, it has not been well studied. They suggest better understanding can emerge through: “research and observations rooted in more general socio-cultural changes, as an understating of how society and culture are changing.”

To an ethnographer, these topics and aims of research sound quite familiar. However, while Norman and Verganti do begin to touch on promising directions to do such work, it is focused on testing out lateral design alternatives, not deep, interpretive research like ethnography. They do in fact mention ethnography in passing—but as a method for incremental human-centered design research, not the meaningful research for which they are advocating. However, their aim is on design research, while here my aim is broadly on innovation in startups. And in startups, I do believe that ethnographic research could be an integral piece of the puzzle in driving meaning for startups, and helping them reach their goals of radical change and diffusion. But, moreover, ethnographic methods could be a valuable, influential asset in reshaping the venture capital sector that controls the startup sphere and largely determines which innovations have a chance to succeed. In the following sections I will highlight, in turn, how ethnographic approaches can aid startups in finding new paths by uncovering and shaping meaning, and how they can make new paths in the startup sphere by infusing meaning into venture capital practices

PATHFINDING IN STARTUP INNOVATION

A Pathology of Startup Innovation

A Lean Methodology – Through my experience and close examination of startups and innovation, an underlying thread that connects many of them is a focus on Lean Startup. Lean methodologies, based primarily on Eric Ries’s works on Lean Startup (2011), still form the core of the practices most Silicon Valley startups— and some enterprises— purport to follow. The work centered on Lean Startup helped spur a startup mania around the globe; it was the first model put forth to describe startup creation as a science and has become dominant in the startup sphere.

The concept of Lean traces its roots back to manufacturing. Lean Production, a term coined in the 1990s at MIT, was initially used to describe the Toyota Production System (TPS) (Holweg 2007). TPS is a socio-technical system that combines a distinct management philosophy and practices. According to the Toyota group that teaches the system, it is based on four core principles:

- put the customer first;

- the most valuable resources are people;

- a focus on the workplace itself; and

- kaizen, meaning “good change” in Japanese, which Toyota uses in the context of “continuous improvement” as a philosophy.

TPS describes itself as “a culture of problem solving at every level of the organization,” and the necessarily skills are learned by doing, not by concept. Following from Lean Production, others have borrowed the term to emphasize a focus on reducing waste and on continuous refinement, although the term is often confused with meaning small teams or low monetary cost.

The term Lean Startup was coined by Ries, who had experience with Agile Development as the Chief Technology officer of IMVU, a 3D social network. Through IMVU, he met Steve Blank, an entrepreneur and investor who created the Customer Development framework. In exchange for investment in IMVU, Blank required Ries to enroll in Blank’s entrepreneurship class at UC Berkeley. Ries was heavily influenced by the course and combined his experience with Agile with Blank’s methodology to create a continuous deployment concept that is heavily influenced by TPS. He primarily focused on two key concepts: Customer Development (Blank & Dorf 2012) and continuous deployment (Maurya 2012).

Lean Startup is thus intended to be a model of innovating rooted in experimentation and rapid iteration. The entire product development cycle is about building a hypothesis, testing, learning, and iterating on it. Using the Build-Measure-Learn framework, a startup theoretically can focus on reducing the time and labor involved in developing the product. In analyzing complexity, fast iteration almost always produces better results than in-depth analysis (Sessions 2006).

The Minimum Viable Product (MVP) is the bare minimum product (or non-technology-based experiment) a team can build to use and test a number of assumptions. By testing this with early adopters, startups can continue to iterate, using Agile development practices such as Scrum or other Kanban (a signboard/scheduling system) principles to conduct short product development sprints. The form of the product may change throughout the Lean process, but the intention is that motivation and overarching vision of the team should remain intact, that is, unless experimentation disproves assumptions. In that case, they pivot. That means they change their focus or strategy based on these learnings. This is where Lean fits into the larger Customer Development framework.

Customer Development is essentially the startup version of user research. Steve Blank, who started Customer Development has defined a startup “[as] an organization formed to search for a repeatable and scalable business model” (Blank & Dorf 2012). His conceptual practice, Customer Development, focuses on this goal and includes four distinct phases: Customer Discovery, Customer Validation, Customer Creation, and Company Building. The first two phases, Discovery and Validation are in a loop, and only when customers are “validated” does the loop breaks off into a linear progression of Customer Creation and Company Building. The process is half of the Lean Startup methodology and parallels the hypothesis-driven Lean Startup approach. The Build-Measure-Learn cycle is centered in the first two phases, and emphasizes validation. Validation is a significant event, although it perhaps gets less and less significant to the core value of the business as iterative cycles continue to improve peripheral aspects. A key event that Lean processes create is forcing a pivot. The team moves into an entirely new direction strategy-wise. Pivoting requires drawing insight from data collected from experimentation, both quantitative and qualitative, and then building a new hypothesis. The methodology also popularized terms like Problem-Solution Fit and Product-Market Fit, creating common startup languages for entrepreneurs, investors, and stakeholders (Blank 2013; Cooper & Vlaskovits 2010). In short, these processes are very focused on incremental improvement, and also oriented toward mass-diffusion.

Beyond Design Thinking – While Lean processes are still dominant, other approaches, particularly from design thinking, have begun to be spread more broadly in the startup community. Design thinking is rooted in combining the context of the problem and empathy—in many ways, not dissimilar from what Customer Development preaches. However, the philosophy and the approach are more grounded in data. This grounded-theory approach provides a structure for patterns to emerge; it allows innovators to arrive at conclusions based on observations early. Thus it sets the stage for alternatives to be examined and experimentation and metrics to be used in a valuable way. In a complex environment, this allows experiments to be more focused on producing understanding, which Anderson et al. suggest is key: “the system is now too complex for a prior [sic] comprehension and thus the product launch is itself an experiment about order or arbiter of order” (2013).

As I have suggested before, combining elements of Lean and design thinking seems to have potential for startups (Haines 2014), and others have noted the potential synergies of these approaches (Müller and Thoring 2012). Lean focuses more closely on business value while design thinking focuses more on developing the right product for the end user. Together, they are useful in terms of thinking about how to provide value for both stakeholders and users at the same time.

But while some “design thinking” methodology has started to make inroads in early stage technology startups, there seems to be much more to explore in terms of approaches. And in particular, it seems we need to go beyond the simplistic tool-based discussions. For startups, it is important to consider other practices that are not currently mainstream within the startup world. As Norman and Verganti suggest, a key to pursuing radical innovation seems to be in conducting research that helps interpret what is meaningful to people—or what could be meaningful. It seems that ethnographic approaches—and ethnographic thinking, as Hasbrouck has articulated (2015)— are uniquely suited to help teams understand meaning and shape meaning through new technologies or business models. In other words, ethnography is well oriented to support disruptive innovation through developing and asking the right questions, pursuing ongoing inquiry, and providing rich interpretations.

Infusing Meaning to Find New Paths

The teams I have studied range from seed-stage, where there’s usually just an idea, to early-stage, functioning startups, to more successful ones that are moving into growth-stage. The majority of them come from the perspective of having an initial idea or a domain or market in which they want to solve a problem. These typically fall into the quadrant that is more focused on diffusion and incremental innovation—the space where Lean is dominant. A smaller subset have created a new technology, often in school, and want to find a market for it. These tend to fall into the vision-driven startup quadrant, in which there is a more radical innovation, but diffusion tends to be limited. Both of these groups face challenges to realizing disruptive innovation with their products, but, as discussed, these categories are fluid, and with the right tools and methods, startups can focus on moving toward more radical innovation… or toward more widespread diffusion (Figure 2). And both of these can be done through developing a broader understanding of embedded meanings and focusing on how new meanings can be developed.

Developing Meaningful Solutions – While all startups initially begin with, at minimum, a general product idea, most have done little, if any, research into the context of the potential user. Some founders come from backgrounds in which they have market knowledge or domain expertise, giving them some level of insight. But in most startups, the conception of research is barely on their radar, and that which is, is rooted in Lean methodology. That is, it is focused on validating the idea with early adopters, developing an MVP, and testing it, not learning about user needs as a starting point or for greater context. “Social proof” –what other people think is correct– is a major goal, rather than really understanding the user. This is an issue rooted in the larger, Lean structure as well as the funding mechanisms. There is a lack of focus in Lean on doing any sort of in depth research. And where some level of research activity is found, it is often boiled down to understanding whether and how early adopters use a product. These studies are typically conducted through reductionist tools, such as Crazyegg heat maps; Mixpanel, and Heap for cohort analysis; tools for funnel analytics; and A/B testing platforms, like Optimizely and Google Analytics. These are often supplemented by some interviews with actual users (early adopters) or cold calling potential would-be users. Beyond those forms, doing research with users and interpreting meaning from users’ perspectives is something generally left out of the picture. And while some of these products diffuse and have solid metrics, there’s often no understanding of why.

One such example of this is Molome, a Thailand-based team I followed at JFDI, an accelerator in Singapore. Molome’s product was initially a sticker app for photos that had grown viral globally, in the days before apps with similar capabilities, like Snapchat. They had incredible signup numbers—in the millions—and were incredibly successful not only in Thailand, but also in Indonesia and in Brazil. But they didn’t know why. The Lean process led them down a path of experimentation… but it never helped them gain any enlightened understanding of what was meaningful about the product to users. They ultimately shifted their product to a meme-generator and folded soon after.

On the flip side this conundrum of having successful diffusion and not knowing why is the me-too product conundrum. For every successful idea, there are scores of copycat products. And, often those copycats are taking an idea that has been successful in one place, like Silicon Valley, and trying to replicate in another region. Aventones, a Chilean startup I followed at NXTP, an accelerator in Buenos Aires, is a good example. Aventones was an online car-pooling system much in the same vein as the original concepts from Uber and Lyft’s predecessor, Zimride. While following the model of some quite successful, disruptive startups, they did not find success themselves. What seems to be lacking was an understanding of how the introduction of this model might present a meaningful change in Chileans lives, where public transportation is safe, efficient, and relatively cheap. And, in following from that, Lean methods didn’t help illuminate how the model might best be adapted to be meaningfully different there.

It seems that particularly in seed-stage startups, which are seeking product-market fit, elements of an ethnographic approach could enable a greater localized understanding of the context or problem space in which a product is being created. As a methodology with a very holistic approach, ethnography seems poised to help new founders gain a deeper view into the context surrounding the potential or nascent product. It would also open up the rigid experimental processes of Lean to more interpretation. Ethnography is an iterative and reflective process that focuses on open-ended questions, as opposed to the fairly rigid, controlled experimental process of Lean. At the front end, it would help in exploring problem spaces, before making hypotheses about them. And as a product develops, ethnographic data provides a deeper level of data on which to base decisions. This need not eclipse the types of data provided by Lean methods. Ethnography embraces both the qualitative and quantitative forms of data. It adds a richer layer of perspective through which to analyze and interpret the quantitative findings. Observing people in all the richness of the context in which they are embedded would not only serve to more thoroughly understand how a product idea might solve any sort of problem, but moreover, what problems there are, how they really matter to people, and, importantly how meaningful the solution might be in people’s lives and interactions. As an approach it serves to interrogate meaning socially, and how that might inform decisions

Mapping Meaning and Interpreting Markets – For other early-stage startups, a major hurdle is that they have created a technology that solves a problem or presents an opportunity, but do not have a clear market for it, so it cannot diffuse widely. Or, they believe they have a market for it, but that market doesn’t embrace it as their vision anticipated. In these instances, the larger issue is less oriented around how meaning might be radically different as a product diffuses in different social settings, and more oriented to understanding how a product that is already radically different might create new meaning for people.

Solapa4, an Argentine team I followed at NXTP, experienced this problem. They had created an algorithm to combine geographic information system (GIS) data sources from satellites. This ostensibly provided a fuller, richer set of data on locations for decision-making in agribusiness, the field in which they felt this would have the most impact. They chose to target crop insurance providers, as they felt their product provided meaningful data to them. It turns out that it is not nearly so meaningful based on the systems of assessing risk in such firms. They have since pivoted and expanded outside of Argentina, but are still in search of making a more meaningful impact in the agricultural domain.

Another team I followed, Scrollback, at JFDI, also faced these challenges. They developed a browser-based Javascript chat tool to replace Internet Relay Chat (IRC). Scrollback is backward-compatible with the open protocol IRC of the past 20 years, which has not seen any major technology innovation through that period. The Scrollback team started with the technology and initially tried to bring on customers from universities, admission offices, online forums, other communities that presently used IRC. But this did not work— they were already used to what they were using. They failed to show how this might be meaningfully different for their users.

In both of these instances, another factor to consider is the current shift from technology-driven innovation into realms where innovation is more technology-aware. That is to say, the current startup environment is much more oriented toward taking technological advances that have already been developed, and applying them in a new domain. And selecting the right domain, and the right market is key.

Founders who have created a technological innovation without a clear user base in mind need to conduct more in-depth contextual research to identify potential product-market fit. One method of doing this is targeting different markets in the fashion of Lean, and seeing what gets traction. But immediate traction doesn’t give insight into how and why something is used– why it would be a good solution for this market. Doing this type of research has implications for the product aims and the user groups that are –or could be focused on, which could be particularly valuable for smaller, marginalized, or otherwise neglected groups. For both founders who don’t know their potential market, and even those who do believe they know their market, there is value in an ethnographic approach, which emphasizes both an etic and an emic approach—giving them a broader perspective, and also getting an situated understanding from the user perspective. For founders who don’t know their potential market, but have done some basic research into it, an emic perspective would help reveal the perspective from the point of view of the user.

Once a startup experiences some success and moves into a growth stage, they are focused on expanding and adapting an established startup product to different markets. Here, ethnographic approaches can help in adapting successful solutions or new technologies to other markets. As noted, some founders come in with local knowledge –often deep, detailed knowledge, and a perspective that drove them to solve a problem. They may have a strong emic perspective in that instance. But then, to grow, they need to gain an emic perspective in a different culture and understand how the society and culture are changing as well. Doing deeper research into other potential markets, while taking an etic perspective to the product vision overall would help to project a more meaningful analysis of the space and allow the founders to step back and reflect on their initial market goals.

Limitations of the Current Model

Resources, Access, and Skills – The potential for ethnographic research to aid in startup innovation is great, but the challenge is how startups access such resources or develop necessary skills. Startups are particularly cash-strapped and scrappy by nature, so they are unlikely to have resources to bring in dedicated researchers or consult research contractors before they are well into the growth stage. Through various networks and programs like accelerators, startups are able to learn many new skills and develop and expand their competencies, so there is some potential for gaining some skills in ethnographic research approaches. But, in reality, the networks of mentors and advisors such programs curate typically come from business-oriented or technology-oriented backgrounds, not the realms of design, UX, or any sort of research, for that matter. Thus, they have little access to the knowledge or resources to help them expand these skills. And those resources and mentors they do have access to generally encourage the current model and Lean methodologies, which reinforces using the aforementioned tools, which are representative of the sort of deskilling of labor in research and UX work, much like Lombardi (2009) described in relation to ethnographic work in the private sector. While there is an opportunity to extend the ethnographic community into the realm of startups, it seems that the current model of funding and prioritization of diffusion are still major barriers.

Moving Beyond the Folk Model – The potential opportunities for ethnographic methods in startups is tremendous. Ethnographic research would indeed be transformative for many startups in terms of developing more meaningful, innovative products. But aside from being unlikely to make inroads given the current approaches and dominant model, it also doesn’t push the needle very far beyond the dominant folk model that exists in corporate ethnography. Ethnographic research in corporations functions much the same way as outlined here—finding a new area in which to develop a product, exploring new markets, providing richer data and a more dynamic understanding of the context, and interpreting meaning. Ethnographic research within startups would be necessarily different from corporate ethnography in many ways, and it would certainly have different sorts of impacts terms of helping startups find and develop new, innovative paths to take. Yet, it still is not too far removed from the folk model. By contrast, a much more compelling, innovative path for ethnographic research to explore – and one which would also have a tremendous impact on startups—would seem to be in forging new paths in venture capital.

PATHMAKING: ETHNOGRAPHIC POTENTIAL IN VENTURE CAPITAL

The current state of innovation coming out of Silicon Valley and other tech hubs seems lacking to many. Many of the products and services emerging at the moment seem to be frivolous, indulgent or navel-gazing; they reflect a focus on Silicon Valley. Recent commentary on the topic suggests the goals of these “innovations” are basically to provide for themselves everything that their mothers no longer do” (Arieff 2016). Not only are women and minorities underrepresented (Whitney & Ames 2014), there is an “echo chamber” that creates a closed system in terms of what is considered novel, useful, or innovative. In short, the products aren’t very meaningful for many people. The reasons are myriad. There’s a focus on potential for diffusion above all else, leading to large bets placed on what the next “unicorn” will be. And those bets tend to come in waves that follow the latest trends projected from Silicon Valley thought leaders, not any sort of meaningful, systematic analyses.

While ethnography holds great potential in helping startups find new paths, as we’ve just discussed, the much more fruitful potential seems to be in guiding funders down new paths. After all, they play an outsized role in deciding what succeeds or fails. Venture capital-backed startups in the tech sector have a much higher survival rate than comparable companies (Parhankangas 2012). If ethnographic research has the power to drive truly transformational outcomes in the startup sphere, it is by helping identify new horizons and forging new paths for venture capital, who in turn shape the startups themselves.

A Pathology of Venture Capital

How VC Works – Access to capital is especially important at all stages, but especially the seed stage of a technology venture, and Silicon Valley provides the most VC funding globally (Kramer & Patrick 2014). This funding occurs through established VC firms and corporate VC arms, as well as through wealthy individuals known as “angel investors.” The origins of this began in the 1950s, when “The Group,” a small network of young investors began pooling investments in technology-focused startups in Palo Alto, becoming key players in the growth of the VC community there (Kenney 2000). By the 1970s, successes had spurred greater investment, and successful entrepreneurs started to become venture capitalists after exiting, organically creating the “virtuous cycle” of capital funding in Silicon Valley. This continues today, with examples such as the PayPal Mafia, a group of former PayPal employees who went on to invest in (and found) many other successful startups (Lacy 2008).

This virtuous cycle explains why there is so much more seed capital available in Silicon Valley than other places, where people tend to put money in stocks, bonds, real estate, or other more stable ventures. VC investments are notoriously risky, with average returns well underperforming other investment vehicles (Huntsman & Hoban 1980). Entrepreneurs-cum-investors, however, tend to have a higher risk tolerance, which in theory helps spur innovation at a much higher rate than corporate R&D (Kaplan & Lerner 2015). According to previous research, VC tolerance for failure help startups “overcome early difficulties and realize their innovative potential” (Tian & Wang 2011). VC firms bridge the gap between entrepreneurs and financiers, dealing with “moral hazard” and asymmetric information (Lerner & Tag 2013). They screen startups, create contracts, stage funding, and closely monitor and often advise the startups they fund. But the way they make money underlies some of the main challenges the startup world is facing.

Venture capitalists make money through financial engineering. They find companies that are undervalued, that have great potential for increasing in value dramatically. They invest at a low price, and eventually aim to sell stocks at a high price as the company garners more investment, grows, and possibly exits – getting acquired or going public. Other, recent changes to structuring capital have also enabled angels to make more investments. Convertible notes enable them to invest in the form of a loan that converts to equity once another round of funding is raised (Feld & Mendelson 2011). This encourages investing in very early rounds, when the valuation of a startup is uncertain and unstable. About 80% of a VC funds’ returns come from 20% of it’s investments (Rachleff, 2014). Increasingly, for investors, it is a “home run” game. They depend on outliers, investments with the potential for extreme returns within five years, usually larger than ten times the initial investment. Essentially, VC funds make lots of small bets in hopes that one will become the next “unicorn” among the likes of Google, Facebook, or Uber. This also means that a lot of those investments fail. In fact, VC funds earn capital gains from only a small portion of their portfolio companies; typically, more that 75% of investments are written off (Hochberg et al 2007). Exits from only a very small percentage of top companies are what drive returns for the majority of the VC industry (CB Insights 2015).

The funds typically range from $50 million to $100 million for seed-stage focus and $100 million to $500 million for later-stage startup investment, with a 10-year lifespan. Partners who manage a VC fund make money from managing these funds in two ways. First, they typically charge 2% of a fund in management fees, so managing a $100 million fund garners them $2 million over 10 years, or about $200k a year. They also make 20% carry— 20% of the profit from the fund. This structure incentivizes them to raise and manage multiple funds simultaneously, and allows them to lock in high levels of personal income, even if they fail to return investment capital to the limited partners who invest in the fund (Mulcahy et al 2012). There is also pressure to deploy at least a third of a fund within the first 3 years of its 10-year cycle so that returns can be realized during the lifetime of the fund. This means there is a rush to make decisions on investing tens of millions of dollars. This rush to make decisions is not good for finding and fostering innovative startups, but notably, it’s also not good for the VC funds themselves..

Challenges for VC – The way VCs are structured, as described above, leads to several major challenges for the VCs themselves. First, there is the virtuous cycle. The fact that many VCs have emerged from successful startup founders themselves means that, yes they have a tolerance for risk and good business insights to a large degree. But that doesn’t provide them broad background and knowledge into domains and markets that they may want to invest in. Second, the structure of trying to get the “home run” investment that counterbalances the others that fail leads to a hunt for “unicorns,” or at least trends following in the footsteps of unicorns. While some VCs have overarching theses around how they aim to invest and there is some level of due diligence before selecting startups, there are no methods, broadly speaking, for doing things in a systematic way. And, importantly, the pressure to deploy exacerbates things. Most invested capital needs to be deployed in the first few years of a 10-year fund cycle, leading to rushed decision-making. This rush to find something links back to the issue of the virtuous cycle as well, as VC partners look to entrepreneurs they know to find something fast. This stifles funding for truly innovative emerging startups who may lack connections.

But beyond stifling innovation, and more to the bottom-line for investors, VCs in general just don’t perform well for the risk they entail. VCs have not out-performed the public market. In fact, a recent study showed that only 20 of 100 funds generated returns that performed 3% better than the public market; the average VC fund fails to make a return on investor capital (Mulcahy et al 2012). Between 2004 and 2014, venture capital as an asset class only slightly out-performed the S&P 500, with an average annual return of 8.1%, compared to 5.7% (Cambridge Associates, 2013). In general, this performance is mostly accounted for by the top performing firms like Andreesen Horowitz, Accel, Benchmark, Greylock, Kleiner Perkins Caufield & Byers, Sequoia, Union Square, and Y Combinator. The top approximately 20 VC firms, account for 95% of the return in the industry (Rachleff, 2014). The others struggle to have the same sorts of networks to source the best startups.

In short, returns are unsatisfactory industry-wide, and venture capital underperforms as an asset class (Kedrosky 2009).

To put things bluntly, as Josh Kopelman, a well-known venture capitalist did: “[F]or an industry that funds innovation – it really doesn’t have that much” (Griffith 2013). In part, this seems due to the lack of structure and of systematic processes within the VC community. While some of the top VC firms have specific theses about the way they will invest or the domains in which they are keen to follow trends, much of the decision making relies on thought leadership and connections. But beyond these informed opinions, there are no general systems or methods for exploring potential domains, finding startups and making decisions on funding them. It seems that it may well be of interest to utilize research more adeptly within these funds, and to have a more meaningful process. VC partners have the capital available to subsidize research, and the returns from having a more informed and thoughtful process would be worth the investment, especially. It seems that incorporating ethnographic thinking and research would be a step toward creating a more innovative VC model, which in turn could fund more innovative startups and hopefully foster more sustainable ones.

A More Meaningful, Ethnographic Approach

There are several overarching challenges for the VC model– in identifying areas of opportunity and trends, and in finding, funding, and fostering more innovative startups.

Identifying areas of opportunity is often based on hunches, rather than research. And in particular, there is a lack of knowledge about different markets globally and burgeoning areas that are spreading tech innovations into other domains and industries and markets. In finding new startups– what’s known as “deal flow”– one of the biggest challenges is that VC firms rely on their internal knowledge and connections rather than solid ideas, and decisions are usually reactionary and informed by a herd mentality. Making decisions around funding startups usually centers on hollow metrics. While there is a level of due diligence, the data sources are not great and lead to funding startups that may not truly be innovative. And finally, fostering startups tends to be an afterthought, particularly in looking at broader impact, values, and sustainability. VC investment controls what startups succeed in large part, so these issues are paramount to fostering innovation in the startup world.

- Gaining meaningful insights and understanding in new markets and domains

- Developing a more holistic and proactive process to evaluate ideas and teams in which to invest

- Providing richer data sources for making funding decisions, and

- Reflecting on and considering values and broader impacts

In the following sections, I delve a bit deeper into some of these issues and highlight the ways in which ethnographic thinking and ethnographic methods can help create a more meaningful process to support innovation.

Meaningful Insights into Different Markets and New Domains – Across the industry, a variety of factors inhibit VCs from identifying areas of opportunity for investment and new paths for finding innovative startups. Most VC firms have some general guiding theses about what they aim to invest in, though they are very similar from firm to firm. They also keep an eye on current investment trends based on what leading firms are doing or what Silicon Valley pundits say the current trends are, making the focus between different firms even more analogous. That is to say, there is much more opinion guiding the way partners identify areas of opportunity for investment, and not much research. Within the firms themselves, this is exacerbated by the self-reinforcing perspectives that emerge from Silicon Valley insularity and from the virtuous cycle that magnifies a focus on certain types of trends. These limit both the markets and the domains that VCs set their sites on.

Paul Graham of Y Combinator has equated the rise of startups as a significant revolutionary force on the scale of agriculture or industrialization. But unlike other revolutions, he argues, the startup revolution does not need local producers. Anyone can create software, Graham says, but “it’s most likely going to come from an ecosystem like Silicon Valley” (Stross 2012, p. 237). This insular view is limiting in a number of ways. While there are certainly innovative startups emerging out of Silicon Valley, there are clearly many others in many other places. Rather than technology being created by Silicon Valley startups for the rest of the world, VCs have the potential to help foster entrepreneurs all over the globe. Yet over a quarter of worldwide VC investment is in Silicon Valley companies, and a whopping 70% in US-based companies. This reinforces the cycle, as those who receive investment generally come from US markets, and Silicon Valley in particular. If successful, they go on to invest in the areas they know and understand.

Beyond that, the herd mentality effects the rest of the world by setting the trends for “me-too” products to be developed. One VC firm I observed in Buenos Aires was a particularly strong example of this. They suggested there were 3 different types of startups there were interested in: 1) concepts that were successful elsewhere that could be adapted for a LatAm market, 2) local solutions with the potential to scale in LatAm, or 3) something completely new. In the general partner session I observed, however, only the first type was discussed. The partners took turns presenting startups they had seen covered in media or heard mentioned elsewhere that were getting funded in Silicon Valley. They discussed each and debated how well it would do if they copied it in a LatAm environment. For instance, Sendah, an online gift remittance payment platform from the Philippines, was interesting and drove a long conversation. But ultimately, the partners thought there wasn’t enough of a remittance market outside of Peru and Bolivia. By contrast, Talkspace, a real-time messaging service connecting users with therapists, they thought would be fabulous in LatAm. After all, one partner suggested: “everyone in Buenos Aires goes to a therapist,” where it was not only socially acceptable, but you were seen as odd if you didn’t. They thought this concept showed promise, and noted it down as one to evaluate further and potentially find a team to pursue. There was no research backing up these assumptions—either about the various markets or how these potential products might be meaningful for users.

It seems there’s great potential for ethnographic research to play a role in expanding the horizons of this focus, certainly beyond US-based markets. An ethnographic approach emerges from both emic and etic perspectives, giving a richer picture of the cultural system being studied. It’s not just about observation, but also interpretation– in what ways is a market changing. It supports a process of discovery, of inferring things and generating deeper questions. This is a natural area of exploration for ethnography, wherein the research can focus on emic validity, and provide a richer picture of areas to explore that might be misunderstood from the perspective of a VC partner. And this extends beyond the focus on new markets, to new domains as well.

One of the major changes in the startup realm in recent years is the shift from tech innovation being centered in information-technology-specific startups to other industries where software is fundamentally transforming the business model. Or, as Elad Gil, a serial entrepreneur, has put it, its a change characterized as a move from “software-driven” to “software-aware” (2016). As prophesized by venture capitalist Marc Andreesen and others: “software is eating the world.” This has been an ongoing trend for several years, but there still a lack of knowledge in the domains in which these transformations are happening. While many investors stick to making bets in areas they understand, others do venture into such new domains, but without much insight. One of the ways of dealing with this lack of insight is to “spray and pray.” That is, investors make lots of bets all over the place to increase the odds of finding a good bet.

An ethnographic approach provides a much better way to approach this— to explore and understand these domains of interest. Having an ethnographer to research the domain would help uncover traditional beliefs and ask the obvious questions to challenge those beliefs– to understand what would be disruptive, and if and how that disruption would help solve certain problems. It would provide insight into the business cultures and trends, representing a domain more close to reality. It would give some contextual understanding to software-aware domains, like IoT, but also potentially to entirely new domains of investment for a firm, like bio-tech.

Importantly, doing comprehensive research can help identify areas of opportunity connecting new domains and markets– areas for positive disruption. Take virtual reality technology (VR) as an example trend. There are engineers who build cool VR stuff, without necessarily having a target market or application area or who focus on the major application of the technology– consumer gaming. Both entrepreneurs and investors think VR can change the world, that it will be a trend. But they often seek solutions that scratch their own itch– they relate it to their own frame of reference because they don’t have knowledge or experience to understand the potential use for the technology in other industries. This is an area ripe for research– to explore such contexts and routines and identify areas of opportunity. To not only discover these areas, but to ask important questions about what matters and why delving into such a domain would be a fruitful realm for innovation.

Finding Teams: A More Holistic Process and Deeper Analysis – The first step in finding, funding, and fostering startups is to be able to identify trends and areas of potential and then connect with entrepreneurs focused in those areas. In current VC processes, there are a number of impediments to creating a “deal flow” that is truly focused on innovation. In identifying opportunities to pursue, VCs are largely reactionary. Most VC’s have an opinion on what is trendy, without necessarily sound reasoning behind it– it typically comes from following other lead investors’ opinions. Moreover, because VC pundits are typically the ones who declare what the trends are, the whole process is self-fulfilling prophecy. If a leading VC says chat bots are the next big thing and invests heavily in them, other investors also pursue the trend of chat bots. Then more entrepreneurs flood into the chat bot trend, seeking funding. The approach the VC firm then takes to choosing from among those startups matters a great deal. Many firms focus on connections, rather than ideas. Andreesen & Horowitz, for example, and many others follow more of a “Hollywood talent agent” model, where they focus on talented teams, rather than ideas. Moreover, finding talent typically happens through networks that VCs navigate, so the startups that ultimately get funded are the ones who already had connections to begin with. The decision making process ranges depending on the firm, and may be a consensus vote, a majority, or a decision made by a single partner, but are generally informed by opinion, not a research-informed, systematic process.

The teams I followed at both NXTP and JFDI in 2013 and 2014 were chosen in a similar fashion. It was heavily influenced by who the specific team members were. Did they fill the necessary roles—or as JDFI put it: did they have a hacker, a hipster, and a hustler? Had they known each other a long time? Were they already familiar with the market? As for the idea—was it in a trendy area, either in terms of domain, like bit-coin was at the time, or similar to ideas being funded in Silicon Valley? Teams looking to dive into more obscure realms or with riskier ideas were often left by the wayside.

An ethnographic approach seems valuable here in several ways. First, it can help in developing a more systematic, grounded process for identifying trends that is anticipatory, not reactionary. Taking a holistic approach to looking at a technology from a historical viewpoint, and then analyzing trends in systematic way, we can look at the deltas and anticipate some of the changes and the directions of those changes. And we can utilize rich anthropological theory in conducting such analysis. Anthropological theories can help us frame, understand, and assess behaviors to inform analysis of these dynamics. And in moving from trends to teams, an ethnographic approach seems most valuable in terms of the rich context it provides.

Funding Choices: Richer Data for Making Decisions – Following from the process of finding to funding startups, the main area of focus for VC’s is performance metrics. The main metrics VC’s look for include: retention (also referred to as churn), growth (in terms of revenue), acquisition growth (number of users), daily and monthly active users (DAU/MAU), amount of time spent (depending on product), lifetime value of a user (in dollars), acquisition cost (how much it costs to acquire a customer), profit margin, and potential market size, which is more of a (usually inflated) estimate, rather than a metric. This forces startups to focus on these metrics to survive; Lean principles instill in startups a very metrics-driven focus that relates back to funding mechanisms. In order to build, measure, and test their ideas, founders must focus on metrics to benchmark progress and make sense of it.

Metrics play a large role not only for VC’s, but for the teams they scout, informing their decision-making process and shaping their understanding of their product and its use. But where metrics provide direction, they can also add pressure for the teams to perform and compete, without questioning the goals. For instance, teams try to optimize for things like conversion rates before they are even certain of their business direction. When a team is too eager to move forward to obtain a milestone, they may not be optimizing for the right thing.

Another common issue is that these benchmarks are often one-size-fit-all. Metrics tend to be overly-simplistic representations of a complex system. The emphasis on metrics can pose a danger by giving false reassurance of progress and growth. Or, on the other hand, can force abandonment of an idea —a pivot— prematurely. The problem therein is that metrics provide minimal meaning or insight. They focus on linear growth and projections to measure progress, and they only act as a scale to measure how successful or not one potential solution has been. And even at that, they are often not indicative of anything beyond a binary. That is to say that we may know that users returned. But we do not necessarily know why. Metrics don’t expand one’s insight around solving a particular problem or developing potential solutions. Over several conversations with one of the startup teams I studied, an advisor repeatedly suggested they really needed to “measure engagement.” The team worked to do more analytics, but they never talked with potential users, so they didn’t really know what was actually engaging about the product. This was common among a lot of teams, who deferred to metrics, rather than getting insight from their users. As a result, founders approach continuing development of their idea assuming they know and understand the complex system in which they are introducing the product.

Lastly, and perhaps the most frustrating aspect for startups, is that metrics can add bureaucratic overhead. One team I followed in Argentina, Gorsh, wanted to move into Brazil as a market for a number of reasons, but an advisor said they needed metrics, numbers to show they should move into Brazil. He suggested they talk to a mentor who was particularly adept at analytics to figure out what to measure. These metrics force teams to work within that specific structure to show progress, rather than following their own journey. Metrics thus become a form of currency. Investors and founders nod and fire off questions based on their perception of how well, or how poorly, a startup is doing, based on such metrics. With the right metrics, a startup can garner more funding; without, it’s unlikely. Metrics mean survival.

It seems that despite using data and doing their due diligence, VCs are not necessarily selecting truly innovative startups, but rather ones that provide immediate quantitative rationale. But growth metrics don’t tell the whole story, particularly in early stage startups. And they may in fact be misleading if something truly has the potential to be disruptive. Reliance on metrics is not going away, but an ethnographic approach would provide an opportunity to extend and enhance the story and complement or contradict these limited data sources. These quantitative metrics don’t tell you why people are using something, how they’re using it, or what underlying needs are addressed. They don’t provide meaning. Ethnographic data would provide deeper focus, and richer context. Within a VC setting, having someone to consult with on qualitative data would be beneficial to both the firm and the startups to get a fuller picture to how the metrics relate to the bigger picture. And would help firms and teams make better, more informed decisions that incorporate metrics into a richer understanding.

Influencing Startups: Reflection and Values – Finally, once a startup receives funding and becomes part of a VC’s portfolio, the firm’s role is to advise the startup and foster their growth and success. A VC partner typically takes an important advisory role for the startup or sits on the board, making strategic decisions to shape the startup’s direction and growth. The firm also draws upon service providers in their networks to help their portfolio companies succeed (Hochberg et al 2007). But, at the same time, the structure of limited and general partners’ investment is such that about 99% of a fund is limited partner dollars; the general partner commits only about 1%, which insulates the general partner from feeling the effects of a poor fund return. These economics encourage the VC general partners to aim for generating high returns in the short term by “flipping” companies, instead of focusing on long-term, scale growth of their portfolio startups (Mulcahy et al 2012). Regarding the majority of startups funded, this part of the process tends to be an afterthought, particularly in considering the startups’ core goals as they relate to broader impact, values, and sustainability. It is here that the most critical assets of ethnographic thinking, as Hasbrouck outlines (2015) would have the most impact—relativism, interpretation, deconstruction, and reflexivity.

In the nascent companies I have observed, VC’s have an outsized impact in shaping their direction, and unfortunately, that is often fueled on how they can gain traction most rapidly and scale, for the benefit of returns. This, then, often has the effect of dramatically changing the focus and vision of the startup itself. Startups focused on smaller or more niche markets are encouraged to jump to bigger, more lucrative ones. Founders with an intense passion for solving a specific problem reorient to other problems that VCs suggest are more worthwhile to pursue. And in the end, there is a distinctive shift in values—a shift that moves teams from doing something potentially meaningful and of value for a particular type of end user to doing something that potentially leads to value for the VC firm.

One poignant example of this is Obatech, whose founders joined JFDI’s program with the grand vision of developing a technological solution to eradicate fake drugs in Indonesia. At the beginning of the program, Obatech’s focus was to create “a mobile-based validation platform connecting good pharma to patients in an emerging market.” But the consistent feedback they received in pitching their idea forced them to reconsider how this solution would work in reality. Would users really be motivated to scan their own drugs? Would they have the ability to, considering the low smartphone penetration rates in Indonesia? Still lacking the resources to develop a pilot study with a prototype, the team began exploring other possibilities. At the suggestion of some VC advisors, they reached out to two regional pharmaceutical companies. The team built a relationship with an Indonesian pharmacy chain and modified their vision; pharma ultimately became their customer. The outcome was a mobile application to “patients with chronic disease buy medicines more cheaply and take them more regularly” by providing data analytics to help pharmaceutical manufacturers. This shifted the focus from creating value for marginalized patients who feared for their safety to creating value for large pharmaceutical manufacturers. Obatech did not last long enough to see this vision either. But their brief existence and dramatic shift in aims highlights some important questions centered around value.

We’ve focused a bit on what it truly means to be disruptive. Disruption suggests radical change in meaning alongside wide diffusion… but this perspective should also reflect on values, sustainability, and impact on the end user. Innovation is an important driver of the economy, but as much research has noted, this does not mean it is necessary or positive (Abrahamson 1991). The types of “value” inherent in a new concept or product need to be unpacked; that is not easy or straightforward, as Graeber has shown (2001), but ethnographic reflexivity can help us get to a more fruitful place. Reflexive thinking needs to be a part of the innovation process, and this extends to the roles that VC’s play in fostering startups as well. VCs would benefit from a broader perspective, that gets them out of their affluent, educated, and mostly white male bubble. They, and their startups need to understand what people—and not just early adopters—value. Otherwise, they are imbuing values into the product without understanding their impact on the end user.

Paths for Practice

There are a few current models that could help shape the way that ethnography could be incorporated into VC practice. As noted, VCs draw heavily upon their networks to identify trends, find startups, and to help their portfolio companies succeed (Hochberg et al 2007). Following from this there seems to be a strong opportunity to incorporate ethnographic research, either as part of this network, or in house.

The in-house model is a potential path where there is already precedence. Many VC funds have Entrepreneurs in Residence (EIR) role, who utilize their expertise to evaluate and perhaps pursue different ideas and assist portfolio companies. Following from this, an Ethnographer in Residence might aim to identify potential trends, identify startups of interest, advise portfolio companies, providing meaningful guidance, and conduct research that is available not just to general partners, but also to the startups they foster.

Design as a discipline has also developed some good working models to bring a design perspective into VC more broadly. Notably, Kleiner Perkins Caufield Byers hired John Maeda, a reknowned designer, as a general partner to bring in that perspective. But other VC firms, like Google Ventures (GV) have also built a solid foundation of design into their practices. They use their “sprint” model, doing deep dives with portfolio companies. Certainly there are opportunities building on this to incorporate ethnographic approaches more deeply into VC practice, either in house, or as a consultant within the networks that VC leverage for so much of the work that they do.

FORGING NEW PATHS FOR INNOVATION RESEARCH

Beyond a Realist Ontology

If we are indeed studying something that is “real” for the purposes of innovation, we are also intentionally trying to understand how we can change it and thus acknowledge the world as socially constructed; we are actively constructing reality. This calls into question the ‘realist’ ontology and epistemology so common in conversation around the predominant folk model of ethnography in innovation. The power of ethnographic methods and ethnographic thinking is not about finding new territory to colonize for startups and for VCs. It is in the rich, reflexive, deconstructionist, interpretivist perspective it provides us. In imbuing an ethnographic mindset into the main elements of the startup sphere, the goal is not to create disruption for the sake of a profitable “disruptive innovation” orientation. It is to make innovation more meaningful. To drive value. Ethnographic approaches enable this in several ways: analysis of complexity, anticipation, attunement, advocacy. The tools inherent in an ethnographic methodological approach allow for analysis of complexity in uncharted terrains. The focus on studying socio-cultural contexts and their dynamics enables would-be innovators to anticipate change in social meaning. An interpretivist mindset underslies the ability to become attuned to a domain, a market, and importantly, an individual human who may be a user. And, finally, being reflexive allows us to understand value and to advocate for those values that make for positive change, not just disruption.

Julia Katherine Haines conducts research at the nexus of technology, innovation, and human practices. She received her PhD in Information and Computer Sciences from University of California, Irvine. She has an MS in Human-Computer Interaction and an MA in Social Sciences. Julia is currently a User Experience Researcher at Google.

NOTES

Acknowledgments – Thank you so much to Ray Wu for continued feedback and discussion on these topics. And thanks also to the reviewers and curators of EPIC for their thoughtful commentaries, which really helped shape this paper.

REFERENCES CITED

Abrahamson, Eric

1991 Managerial Fads and Fashions: The Diffusion and Rejection of Innovations. Academy of Management Review, 16(3), 586-612.

Anderson, Ken, Tony Salvador, and Brandon Barnett

2013 Models in Motion: Ethnography Moves from Complicatedness to Complex Systems. Proceedings of EPIC 2013, 232-249. https://www.epicpeople.org/models-in-motion-ethnography-moves-from-complicatedness-to-complex-systems/

Arieff, Allison

2016 “Solving all the Wrong Problems.” New York Times, July 10, 2016. http://www.nytimes.com/2016/07/10/opinion/sunday/solving-all-the-wrong-problems.html

Blank, Steve

2013 The Four Steps to the Epiphany. Pescadero, CA: K&S Ranch.

Blank, Steve G. and Bob Dorf

2012 The Startup Owner’s Manual : The Step-by-Step Guide for Building a Great Company. Vol. 1. Pescadero, CA: K&S Ranch.

Borneman, John and Abdellah Hammoudi

2009 Being There: The Fieldwork Encounter and the Making of Truth. Berkeley, CA: University of California Press.

Brown, John Seely

2012 The Evolution of Innovation. Research-Technology Management, 55(5), 18-23.

Brown, John Seely and Paul Duguid

1991 Organizational Learning and Communities of Practice: Toward a Unified View of Working, Learning, and Innovation. Organization Science, 2(1), 40-57.

Brown, John Seely and Paul Duguid

2002 Local Knowledge: Innovation in the Networked Age. Management Learning, 33(4), 427-437.

Bundy, Wayne M.

2002 Innovation, Creativity, and Discovery in Modern Organizations. Westport, CT: Quorum Books.

CB Insights

2015 Which Venture Capital Firms Are Consistently In The Largest Tech Exits? CB Insights, July 25, 2015. https://www.cbinsights.com/blog/venture-capital-firms-largest-exits/

Cerf, Vint G.