Case Study—Trust motivates people’s uptake and use of digital financial services (DFS). Understanding the socio-cultural determinants of DFS trust are needed to scale financial access and drive financial inclusion. These are core components of international development strategies, such as the Sustainable Development Goals (SDGs) or Universal Financial Access (UFA2020). The IFC-Mastercard Foundation Partnership for Financial Inclusion (the Partnership) conducted ethnographic research to understand factors that impact people’s attitudes and perceptions of DFS. Nine months of field work each in Cameroon, DRC, Senegal and Zambia were conducted, in collaboration with local research institutes’ Anthropology departments and the African Studies Center at the University of Leiden. The results of the ethnographic research produced a framework for understanding drivers and barriers to people growing trust in digital financial services.

This paper analyzes the quantitative and qualitative application of the framework for understanding digital financial services perceptions and uptake propensities for a specific market segment: micro, small to medium-sized enterprises (MSMEs). The framework guided the design of focus groups and survey instruments, whose data provide a classification of issues business owners face for adopting DFS and the degree to which the socio-cultural determinants of these issues may drive or hinder DFS adoption. Further, the survey data provide ground-truth observations that are applied to transactional big data sets toward the development of a model to identify business from individual customers. Identifying MSMEs enables providers to deliver business-specific DFS services at scale and further enable financial inclusion.

It was found that MSMEs could be successfully identified using the big data analytics model, and that the classification of small-medium (and micro) segments could be further identified by application of the survey data. Using the framework throughout all stages of the analysis further demonstrates the business value that can be obtained by employing the ethnographic approach. Doing so ensured that salient DFS issues relevant to business owners were inherent in survey questions ex-ante, thereby yielding meaningful results that can be used to engage MSMEs, design relevant products and advance financial inclusion.

INTRODUCTION

The IFC-Mastercard Foundation Partnership for Financial Inclusion is a $37.4 million joint initiative of the International Finance Corporation (IFC) and the Mastercard Foundation to advance Digital Financial Services (DFS) in Sub-Saharan Africa. The seven-year program was launched in January 2012, and works with microfinance institutions, banks, and mobile network operators to develop and test innovative business models for financial inclusion. Financial inclusion supports individuals and businesses to have access to useful and affordable financial products and services that meet their needs—transactions, payments, savings, credit and insurance—delivered in a responsible and sustainable way. This specifically targets underserved market segments, reaching individuals who disproportionately lack access to formal financial services, such as women, rural households and poorer income demographics. To-date, the Partnership with 14 African financial services providers has achieved an increase of 11.4 million new digital financial services users on the continent, 45,000 new banking agents, and $300 million in monthly transactions (“Digital Access: The Future of Financial Inclusion in Africa”, IFC 2017).

Digital financial services have expanded rapidly across Sub-Saharan Africa over the past decade, allowing millions of people who previously did not enjoy access to formal financial services the ability to make payments, save, borrow, and sometimes become insured with a few clicks on a mobile phone or a finger’s swipe at an agent’s point-of-sale device. However, new technologies always embody changes in a society’s economic relations; the way a society embraces new digital technologies and services, or resists them, depends on socio- and cultural factors that are specific to that society. These factors influence the consumer’s trust in DFS and ultimately their overall use and level of activity.

To gain a better understanding of African DFS users and capture a sense of the deeper fabric of the emerging markets, the Partnership commissioned “An Ethnographic Study Into the Perceptions and Attitudes Towards DFS in Cameroon, the Democratic Republic of Congo (DRC), Senegal, and Zambia.” (De Bruijn and Butter, 2017). The four countries were chosen to encompass both anglophone and francophone markets at the early stages of DFS development. Beginning in September 2015, a research team at the African Studies Center Leiden, the University of Leiden, gathered data over the course of one year to gain a better understanding of the African DFS user and capture a sense of the more profound fabric of the emerging market. One of the central questions in this study was whether DFS will be able to allow for increased financial inclusion of people in global economies. To assess this, the researchers used ethnographic research methods to examine the socio-economic, cultural, and political factors that contribute to the uptake of DFS.

An Ethnographic Study of People’s Perceptions and Attitudes Toward DFS

“The Ethnographic Study into the Perceptions and Attitudes Towards DFS in Cameroon, DRC, Senegal, and Zambia” aimed to capture and document these socio-cultural relationships, framed by a central question to understand what digital financial inclusion means in different African contexts in relation to historical, cultural and social factors. Researchers sought to examine the mobility of digital money through mobile phones in relation to societal power dynamics, existing modes of access to wealth, and social relationships; and to contextualize this understanding in terms of traditional forms of money and cultural perspectives on the mobility of people, goods, services and transfers of value. The research teams spoke to both users and non-users to learn what cultural or socio-economic drivers and barriers to uptake there may be, and also how the introduction of DFS may alter or influence social relations and cultural norms. Hence, the researchers followed various actors in their use of a variety of services.

While DFS providers often employ both quantitative and qualitative market research to better understand the customer and the opportunities and challenges of the market, such research tends to focus primarily on existing demand, pricing, and product design. In contrast, using an ethnographic approach to understand what digital financial inclusion means in different African contexts brings nuance to understand how sociocultural factors influence what it means to be financially included or excluded in peoples’ own words. A primary goal of the study was to amplify the voices of DFS users and thereby provide insights into why people are motivated to use DFS; and, equally, why people may not seek to use such services. The study contextualizes these motivations through a cultural lens to articulate specific socio-economic and political contexts in which mobile money plays an essential role in the decisions that consumers make.

These motivations are in turn distilled into a framework that categorizes the salient socio-cultural parameters that serve as drivers or barriers for individuals to use digital financial services. It particularly aims to distill the voices of individuals who lack access to formal financial services and who may be most served by greater financial inclusion. It provides a structured approach to understanding customer market segments by articulating a framework of enquiry whose answers can help inform marketing strategies, product development, or the placement and roles of agents by better understanding the needs and perceptions of the individuals these products are intended to serve.

To synthesize the study’s findings in a way that translates easily to practitioners, the Partnership for Financial Inclusion published “A Sense of Inclusion: An Ethnographic Study of the Perceptions and Attitudes to Digital Financial Services in Sub-Saharan Africa.” (Heitmann et al, 2017). The goal of this report was to focus on the core framework that was identified by the original study to support digital financial service providers and implementing partners with operationally-focused insights on how these factors may influence the decisions consumers make.

As IFC is working to scale digital financial services in Sub-Saharan Africa through its advisory services operational projects, this presents a unique opportunity to incorporate the results of the ethnographic study directly into an operational context. This case showcases the experience of operationalizing ethnographic findings in IFC’s advisory services project with a financial service provider to expand access to digital financial services in an emerging Sub-Saharan African market.

Background and Summary of the Ethnographic Research

“The Ethnographic Study into the Perceptions and Attitudes Towards DFS in Cameroon, DRC, Senegal, and Zambia” aimed to broaden the scope of DFS research in a way that accounted for the complex ecosystems in which customers who use these services live. Using qualitative data to assess the decisions consumers make by truly amplifying their voices, researchers attempted to gain a more nuanced understanding of the formal and informal economies in which DFS operate. Painting a bigger picture of these economic ecosystems through the words of DFS users and non-users is extremely valuable when it comes to comprehending the status of financial inclusion in the four African countries evaluated in the study. Drawing connections between DFS and access to wealth in the research sites, researchers aimed to extract themes surrounding the various factors that influence the uptake of DFS and the ability of these services to increase financial inclusion. Furthermore, ethnography helped discover the regulations, both formal and informal, power differences (gender, age, social/political hierarchies), access and appropriation of technologies surrounding DFS users and non-users. The following section summarizes the study’s approach and includes excerpts of the research methodology and findings.

Within the overall research methodology of ethnography, the research team employed a variety of methods throughout different phases of the study: interviews, focus-group discussions, observation, participation, life histories, visuals, archival analysis, keeping a logbook and diary, emic discourses, and thick description. About 430 interviews and 13 focus-group discussions were conducted across the four countries analyzed.

A TOOL TO UNDERSTAND TRUST TOWARDS DFS: THE SIX-FACTOR FRAMEWORK

The primary research takeaway is a framework that provides crucial insight into users and non-users’ usage, perceptions, and attitudes towards mobile money in four study countries. This socio-cultural framework articulates critical factors that may drive or inhibit use and trust towards digital financial services. In order to understand the society and ecosystem in which DFS is introduced, it is important to look at the historical roots of monetary transactions as well as the current mobility of people and money, and peoples’ motivations for moving money. This provides a context with which to interpret peoples’ perceptions of digital financial services, particularly in contrast with the new technologies with which these services are delivered. Further, informants articulated feelings for how they do or do not “belong” to such new technologies, and how economic stratifications within society play a role in this dynamic and perceptions of digital financial services are affected by these factors.

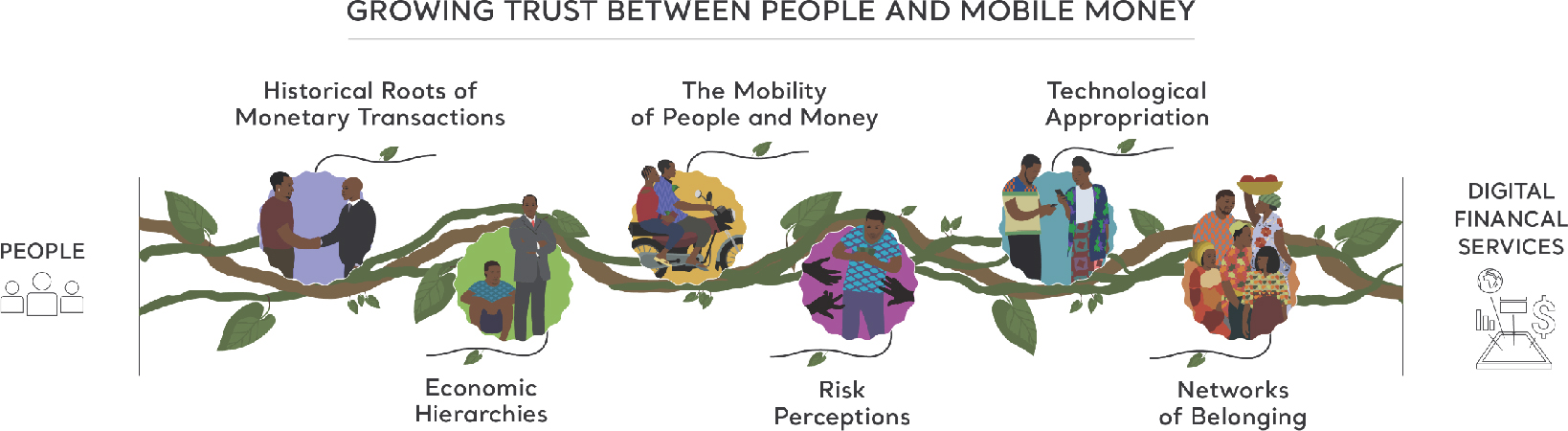

There are therefore six themes included in the framework: historical roots of monetary transactions; the mobility of people and money; technological appropriation; perceptions of regulation and consumer protection; networks of belonging; and economic hierarchies. Trust emerges as an overarching theme and determinant of peoples’ willingness to take-up digital financial services. This feeling of trust is articulated through a holistic understanding of these six themes. An element of application of the study and its framework is communications, for which additional materials are developed. The key framework graphic is shown in Figure 1: infographic icons are arranged on a leafy vine. The vine is intended to represent linkages between these framework topics, while also embodying the organic nature of ethnographic research and the fluidity of socio-cultural elements across different contexts and demographics.

Figure 1. Framework Graphic

Historical Roots of Monetary Transactions

The research indicated that past experiences with financial institutions and their historical performance influences people’s perceptions of the financial sector and financial services, generally. The two major factors that emerged in the four countries were historical perceptions and experiences with financial institutions, as well as historical reliance on social networks. The data showed that an individual’s trust in DFS was heavily correlated with the historical confidence, or lack thereof, that people had regarding banks and financial institutions in their country.

Nowadays, there are many options for people to use formal financial services. On the one hand, historical familiarity with remittances, domestic or international, often serves as a driver for DFS adoption. On the other hand, the perceptions based on personal negative experiences or socialized memory of those experiences about money may present barriers that are passed from one generation to the next one; these barriers can inhibit consumers to adopt new digital financial services today, even if such financial risks are no longer present.

The Mobility of People and Money

Cultures of mobility emerge from social phenomena such as sending economic remittances to spreading social networks, creating economic opportunities in a household, and social contact over distance. Domestic remittances were the launch use-case for DFS in Africa, providing a sought-after solution to send money safely, quickly and cheaply. An existing cultural understanding and need for the mobility of money helped drive this adoption. Historically, this culture of mobility often originated in stories of migration and iterant laborers who needed to send back goods and wages.

Social networks have long played an important role in monetary transfers in the research countries. For example, people have trusted intermediary money handlers to send money to support relatives back home in their villages. This reliance in social networks to move money can compound reliance and trust in traditional financial services, as adopting alternatives can mean breaking away from these social networks. This phenomenon is evident in the continued popularity of semi-formal credit unions and savings clubs in some of the research countries.

When this need for money and people to move is recognized by the society as a cultural norm, this works as a driver for use and adoption of DFS and permits the new services to integrate into familiar norms.

Technological Appropriation

The uptake of DFS is strongly linked to experiences with the technology and knowledge of how the technology works, as well as fears of what the new technology may bring. In a broader sense, technological appropriation is not only related to skills and technical literacy, but also how the technology itself may change social customs or habits.

While the spread of DFS in the four study countries has in part been due to the reach of Mobile Network Operators (MNOs, i.e. cellular phone companies), network coverage remains a challenge for customers who wish to use these financial services. When cell network coverage is not always reliable, and agents may not be present, DFS users not only struggle to make transfers, but also sometimes lose money in the digital void (or may attribute “lost” money to technology problems, whereas in reality the issue may be due to not understanding services fee deductions, for example).

In markets where trust in the financial sector is historically low, or where financial literacy and awareness is low, a single bad experience can damage the reputation of providers overall. There were also problems with money being sent unwittingly to the wrong number, especially during MNO promotions. Furthermore, some participants recounted stories of being unable to recover the money they lost due to inadequate information and the inability to access an agent. Additionally, some agents end up running out of float—namely, cash with which to complete transactions—which forces customers to either return to the booth later or find another agent, harming the overall reputation of DFS providers as customers perceive the broader serve to be unreliable.

Another issue that arises with technological appropriation is a lack of access to information, something which is particularly important for first-time adopters. Increased promotions and more effective television, radio, and print advertisements are necessary to motivate consumers and help the population understand how DFS work. However, informants overwhelmingly expressed the need for more adverts providing step-by-step instructions and for agents to engage more directly with customers until they become comfortable with the use of mobile money technology. These advertisements need to be displayed in local languages and accessible to lower-income consumers; moreover, ineffective advertisement also discourages potential adopters.

Related to messaging, informants articulated how the core value proposition of many mobile money services (the ability to send money quickly and easily right from your phone) can present disincentives for uptake for fear that the technology can chance social norms. Specifically, that the technological chance can deny socially-acceptable excuses to say ‘no’ to family and friends that ask to borrow a little money by saying sending it is too difficult. In this sense, technological appropriation can present a barrier to uptake, motivated by the concern of how technology can change family and social relationships.

Additionally, there could be negative perceptions based on cultural norms. For example, in communities where group-based financial relationships and face-to-face interaction are prevalent, DFS brings technology that delivers individual empowerment, and this might pose social disruption.

Experience with technology and how it works and its tendency for individual empowerment and social disruption can be either a driver or a barrier to embracing digital financial services.

Perceptions of Risk and Customer Protection

The data indicates that many informants are skeptical toward DFS due to a lack of information about regulatory aspects of the financial system. A lack of information on risk in the financial system in general, and for DFS in particular, has created distrust towards DFS in some markets. This is especially true for unclear information regarding consumer protection.

These sentiments can diffuse throughout social networks and create barriers, even in cases that are not factually based. Even when policies have been introduced and rights are known to customers, some informants complained that in reality there are no guarantees that the policies are enforced. Informants in the research countries reported money disappearing, getting “lost in the system”.

The spread of information about risk in the financial system can also create opportunities to build trust around new solutions technology brings. In a given a context of distrust on the traditional banking sector, DFS are perceived as a more secure option, moving people to trust and uptake the new technologies and services.

Networks of Belonging

In African markets, semi-formal social financial networks have often played a central role in the absence of formal financial services. These networks support and guide many of the informants in this study, whether the networks are among family members, friends, co-workers, or other social groups. Community is a widely shared value in the four countries surveyed, and DFS have the power to impact and transform peoples’ social networks in various ways. Belonging to a financial community, like a semi-formal credit club or savings society, provides social security in a way that commercial financial services providers may not. Digital Financial Services can be seen to challenge existing norms and identities but can also opt to affirm social relationships to drive DFS usage and social trust.

Networks of belonging and the social aspects of money transfers serve as large factors in the decision-making of users and non-users of DFS. Additionally, informants praised the anonymity of DFS, as it allows them to send money while maintaining privacy (that is, not being observed dealing with money in a public setting by being able to conduct transactions independently through a mobile device). DFS may help to circumvent the use of social networks for monetary transfers, hinting at a change in society related to the possibilities of anonymity and individualization offered by DFS.

The researchers found that while many informants would use DFS for payments, they would turn to established structures for savings and credit, including family and friends. In many cases DFS are unable to establish a similar social solidarity that may be found in informal credit unions and money-saving groups that exist in the four countries surveyed.

Economic Hierarchies

While it is clear that some individuals felt excluded from DFS due to their financial status and position within existing societal economic hierarchies, researchers wanted to examine this idea further by looking at the possibility of DFS disrupting these hierarchies at a more systematic level. Compared to traditional banks, Digital Financial Services are often seen as more accessible and affordable alternatives for people who have long been excluded from formal financial services. Historically, banking services were perceived as available only to a small elite (and often this perception was factually sound, such as by having a pensioned job an as eligibility requirement to open a bank account, for example).

Currently, factors such as self-exclusion, lack of resources, and superstition contribute to a feeling among lower-income individuals that they are not affluent or successful enough to use DFS. In some cases, informants tended to equate banks with large amounts of money—and therefore only for people with large amounts of money—giving rise to an oft-reported sentient of ‘that’s not for people like me’

Data showed that DFS does in fact have the potential to help lower-income individuals move up the economic ladder in several ways. For example, DFS offers a tool for small entrepreneurs to monitor business growth without financial expertise. It can help facilitate business transactions where traditional infrastructure is less developed. DFS do have the potential to bridge the gap between informal and formal banking and improve peoples’ livelihoods. DFS can serve as a stepping stone to formal financial services, providing opportunities to entrepreneurs who find themselves starting out with low budgets.

It is important to understand how Digital Financial Services are viewed in relation to the socio-economic status within a given market; that is, if it is generally perceived as accessible or inaccessible by the unbanked. On the one hand, economic hierarchies can work as a boundary for people to adopt DFS; on the other hand, the improved economic status can be aspirational and therefore, DFS could be seen as an enabler to access to a more prosperous and prestigious position in the community.

Trust as an Overarching Theme

One of the main findings was that trust is a crucial and overarching theme. Trust is the overall outcome of the six themes in the analytical framework above, creating a unique fundamental context in each market. Providers who fail to understand and relate to this context may struggle to launch and grow DFS services to financially underserved market segments.

Numerous interviews revealed that a feeling of security is vital to the uptake of DFS in the four countries surveyed. Beginning with the history of banking and government interventions, informants trust of DFS was largely correlated with their perceptions of finance industries and the history of these industries in their country. It was clear that these historical perceptions have the ability to transcend the past and affect current-day decision-making among users.

Trust was also intimately tied to the social aspects of money transferring among communities. For example, informal credit unions provide much more than financial services, giving participants a community that they can rely on while also giving them the flexibility to save small amounts of money and still gain interest. In areas where these unions remain popular, they serve as major barriers to DFS services, as participants trust them more than they do DFS.

Understanding the safety of mobile-money transactions also requires an element of trust from users of DFS. Especially in areas of low digital literacy, it can be difficult to trust that DFS will safely store or transfer one’s money. This is exacerbated by network issues and examples of people who have lost their money by using DFS, often due to the poor network connection in rural areas (which can cause transactions to appear to fail, prompting users to resend and try, try again, only to effect multiple debits unintentionally and create a sense of money lost). When users are unable to recover their money, trust is lost, and these news spreads quickly among social networks—and this in turn inhibits the uptake of DFS by new users. Many non-users have in fact heard numerous negative stories about the services, and they attribute their non-use to these discouraging reports.

Through observing the way people handle and manage money across all four of the selected countries, researchers gained great insight into the feelings of security and trust that are tied to exchanges of money among social networks. The social element also remains vital to an understanding of the mechanisms of trust surrounding mobile money and its possible impact on financial inclusion. To succeed, DFS needs to provide value to users while also working to socialize trust in these types of services.

BRINGING THE FRAMEWORK TO THE PRACTITIONER’S ARENA

The ethnographic framework presented in this study is designed to be used. Each theme provides a category for exploring historical, social and cultural DFS drivers and barriers at the overall market level. As such, it may help providers identify areas of specific concern to increase DFS uptake or activity. This six-factor framework provides an understanding of cultural perceptions in a target market by giving practitioners the categorical questions to ask.

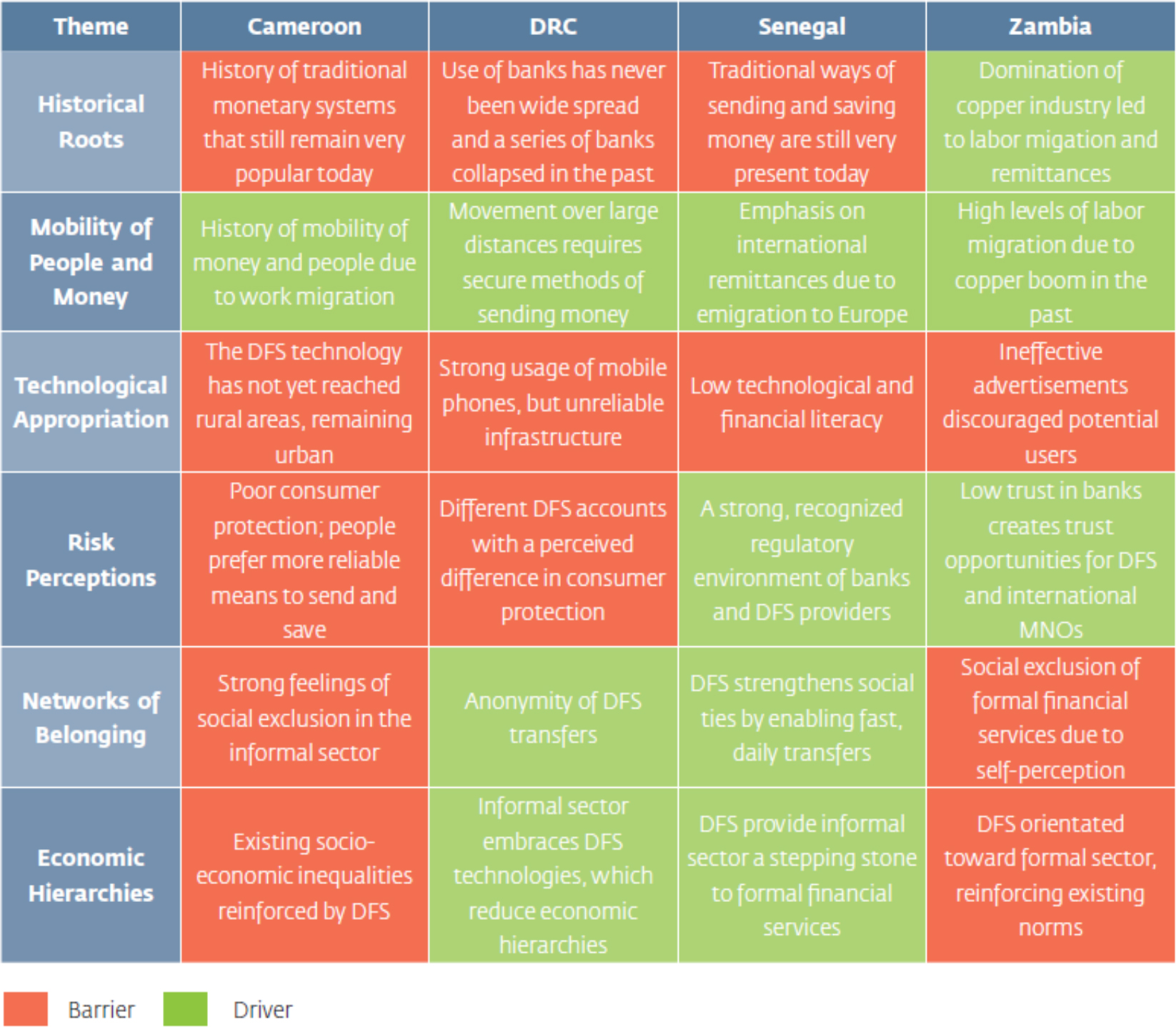

As presented in “A Sense of Inclusion,” each of these six framework themes may constitute either a driver or barrier toward trust in digital financial services and therefore willingness for an individual to take-up usage of these services. Importantly, as the underlying ethnographic study reports, the respective socio-cultural norms in each of the four study countries may be characteristically different. Synthesizing these differences according to the six-point framework help to characterize overall trust perceptions toward digital financial services. This is presented in the following matrix diagram.

Table 1. DFS Drivers and Barriers

A high-level interpretation of this matrix therefore suggests that an operator implementing digital financial services in Cameroon, for example, might face more socio-cultural barriers to uptake as compared to Senegal, where service providers might find more inherent socio-cultural drivers for a similar service targeting financial inclusion.

“A Sense of Inclusion” illustrates how the framework may be used to characterize and describe the financial inclusion market broadly, in terms of customers willingness to trust the service and value proposition. More specifically, the report encourages providers to apply the framework directly as a method for designing better products and engagement strategies that understand the underlying socio-cultural factors that may either stimulate or inhibit customer uptake of digital financial services.

Potential Uses of the Framework

The framework may help to identify historical, social or cultural pain points that hinder DFS uptake, such as a historical mistrust of the financial sector in the DRC. These may be turned into value propositions instead, similar to how disruptions have driven DFS uptake in some markets.

- Acknowledge and understand drivers and barriers in each market: There are existing historical, social and cultural drivers and barriers to DFS uptake in every market. Providers would be wise to leverage the drivers and to ensure not to impose any further barriers. It is equally important to acknowledge that these factors differ from market to market and that one factor may be a driver in one market but a barrier in another.

- Perform market risk assessments: When examined together, the six themes provide a high-level risk assessment for a given market in terms of which markets or segments face higher or lower barriers for entry with respect to the socio-cultural context.

- Adopt a customer-centric approach to DFS: this framework brings the voice of users and non-users and their perceptions and attitudes towards new technologies and digital services at stake. Therefore, this tool can help to design new products with customer centricity in mind.

- Craft more compelling customer value propositions: Customers interpret the DFS value proposition in terms of their socio-cultural perceptions. This framework can be used to identify what people value. The result will be stronger value propositions for digital financial services and products that reflect and effectively address end-users’ concerns and preoccupations.

- Design targeted marketing strategies: This framework is a helpful tool to design marketing strategies more sensitive to cultural complexities and marketing materials that inspire trust and move customers to use DFS.

Implementation of the framework

The IFC-Mastercard Foundation Partnership for Financial Inclusion works with partners and clients to scale digital financial services in Sub-Saharan Africa and has therefore opportunities to directly apply results of the ethnographic study in an operational context.

The following sections look at a first use case of the ethnographic framework: its application and results in another African DFS market. Activities aim to further refine lessons through practical usage in an operational project. This is done with a higher-level goal of using the results of the study to build replicable tools or methods that have been guided by the ethnographic process to support clients and IFC operational projects to better achieve their objectives of expanding reach and deployment of digital financial services to underserved markets. Moreover, the goal is to refine the survey by incorporating the lessons learned from this first case study and then to build standard survey modules to apply them to further research in the region.

In the African DFS market for this case study, key gaps remain that IFC and its Client, a Financial Service Provider (FSP), are tackling to develop DFS products to meet the needs of low-income populations. While individual consumers can access digital financial services, relatively speaking, the business sector of micro-small-medium-sized enterprises (MSMEs) is far less supported in the market. Critically, MSMEs are recognized as a core driver for economic growth and job opportunities, which is why supporting the sector is a focus for many development strategies, including the UN’s Sustainable Development Goals (SDGs) (Ke Liu, 2018). In order to target MSMEs better with DFS and to be able to respond to their needs, the project aims to build a predictive model to (1) identify MSME clients based on their financial transaction behavior in order to (2) better design product offering to their respective needs.

The market research and data analytics component of the IFC project attempts to address the challenge of identifying MSMEs among a financial service provider’s customer base and to understand their needs, to help engage the market and to provide them services they want to use. As well as to understand the customer segment and their reticence or affinity to use DFS services that a business offers, such as merchant payments. Moreover, understanding this customer sentiment is as applicable to the businesses themselves, as for many of the smallest businesses, the owner and the business are one and the same. The Partnership’s Applied Research and Learning team is tackling these challenges by incorporating the six-point ethnographic framework into operational surveys with these businesses, whose results inform will inform a big data analytics project that aims to segment and predict MSMEs in the Provider’s customer base.

Research Design

The predictive analytics research study is designed on the hypothesis that within the FSP’s network, business owners are using digital financial services to support their business using individual service subscriptions; and that the usage patterns of these individual business users are characteristically different from those of individual consumers. The analytic challenge is therefore firstly to segment MSMEs from the individuals who are generating gigabytes of transactions every month. Then, to create a statistical profile of how businesses versus individuals use these services. Finally, to use this understanding to refine DFS products and engagement strategies to help businesses and customers come together in the digital ecosystem.

A ground-truth understanding of who businesses and individuals are is critical to this approach. Where patterns exist in the data, to understand if these are expected to meaningfully correlate with how these segments characterize their own use cases (or lack thereof). The six-point ethnographic framework was operationalized for this purpose by incorporating questions into structured surveys and focus groups, whose results aim to advise exploratory analysis of telephony and mobile money usage patterns within the transactional datasets on the analytic side. And once results are achieved, to help interpret probability scores generated by these segmentation models and guide operational engagement strategies through a better qualitative understanding of why business owners may (or may not) wish to take-up digital financial services that are specifically designed for business needs.

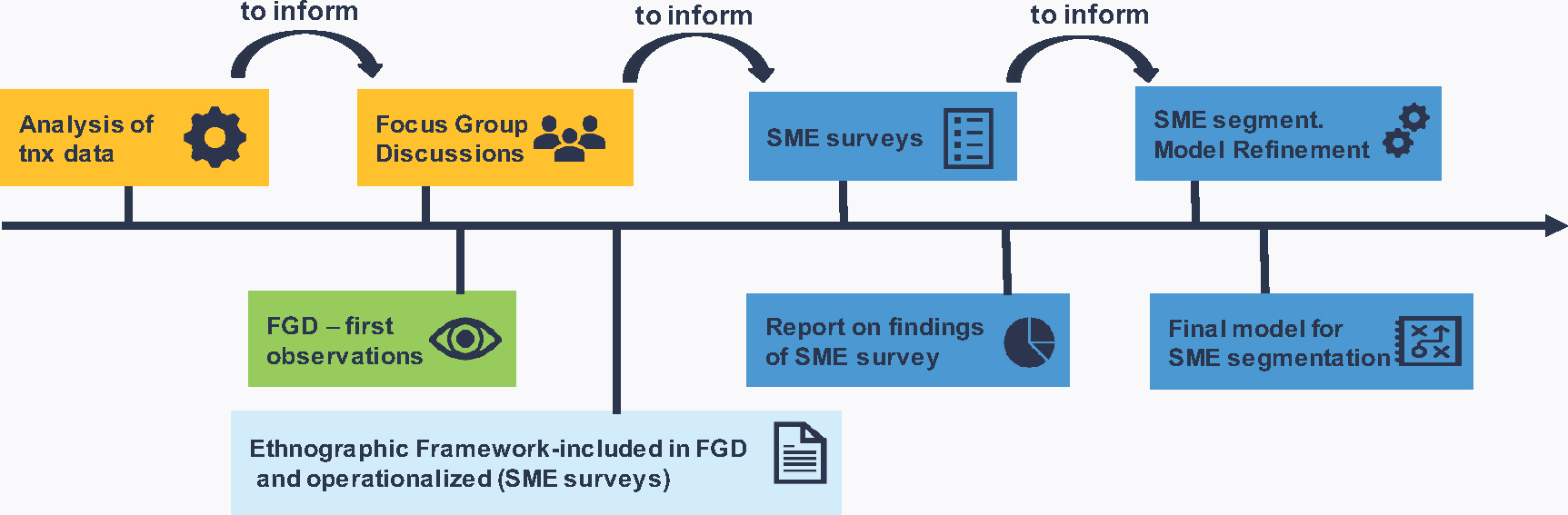

The method of incorporating the six-point ethnographic framework into ground surveys is presented in the following diagram:

Figure 2. Flowchart to operationalize ethnographic findings

Implementation

In April 2018, researchers facilitated 6 focus group discussions with digital financial services users (enterprises, micro-entrepreneurs and consumers). The focus group discussion (FGD) guide question design was informed by the ethnographic framework. By understanding ex-ante broad socio-cultural drivers (or barriers) to DFS usage, the researchers and focus group facilitators are better able to bring attention to salient factors. Furthermore, the framework is employed again following the focus groups, to aid interpreting participant’s feedback and distilling their voices into specific issue questions that can be incorporated into large-scale market survey instruments that in turn provide ground-truth data used for predictive modelling.

Focus Group Discussions

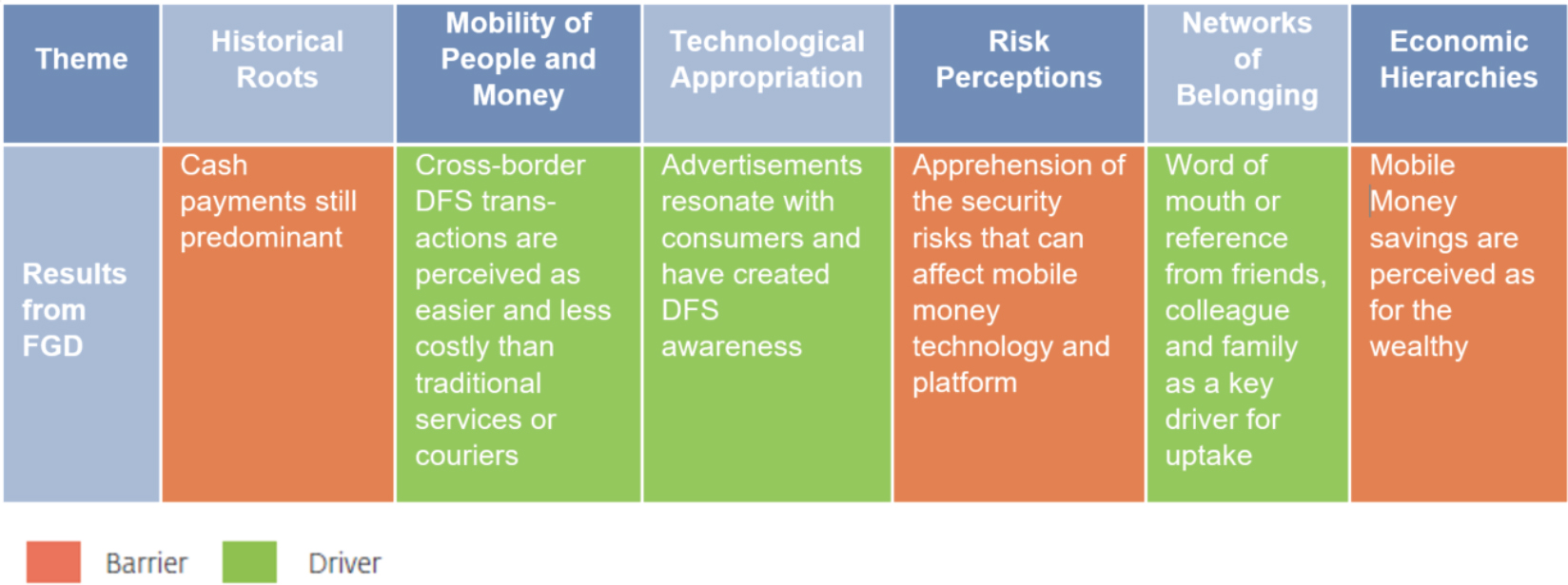

Preliminary results obtained during FGDs shed light on users’ perceptions and attitudes towards mobile money in the given country. As in the case of the four countries of the Ethnographic Study, the overarching theme—trust—is very relevant to this country context. Using the approach articulated in “A Sense of Inclusion” a high-level summary of the FGDs are presented as follows:

Table 2. Qualitative Results Summary of Focus Group Discussions

In the case of consumers, in the past, people used to rely on Money Transfer Organizations (MTOs) or courier services to move money. Currently, users prefer mobile money services. They consider the latter more affordable and more accessible to use than traditional forms of transferring money. Users understand there is an inherent risk of transferring money digitally; moreover, it is one of the biggest consumer fears regarding mobile money, pointing to growing dependence on mobile money and the impact of the disruption to normal daily life. Networks of belonging influence people’s perceptions on DFS, as word of mouth or reference from friends, colleagues, and family has also played a key role in driving DFS uptake in the studied market.

For MSMEs, the larger the size of the firm, the more frequently firms seem to be willing to adopt DFS. For MSMEs, formal and informal, there is an awareness of the advantages the use of DFS brings vis-a-vis the use of cash. However, only the largest companies appear to have the ability to entirely switch to digital payments using mobile money accounts instead of continuing depending on cash or the traditional bank accounts. For smaller firms, cash is the substitute when DFS are not available. Besides, the larger firms with higher levels of formalization are demanding a higher level of sophistication concerning DFS product offering, for example, loans on the DFS account, to increase the use. Moreover, during FGDs respondents argued that with an adequate digital product offering there would be no incentives to use banks.

In our market of study, MSMEs respondents value the privacy of transactions agents bring compared to a bank, as going to banks also carries a risk of being robbed when leaving the bank with money that is visible to onlookers. For informal MSMEs, respondents from the informal sector believe that digital financial services have created platforms for employment and helped in securing payment of personal bills.

Market Surveys

Building on the insights obtained during the focus group phase, the research team designed surveys to further segment MSMEs and to use these results to advise exploratory analysis and pattern identification in the significant data analytics modeling process.

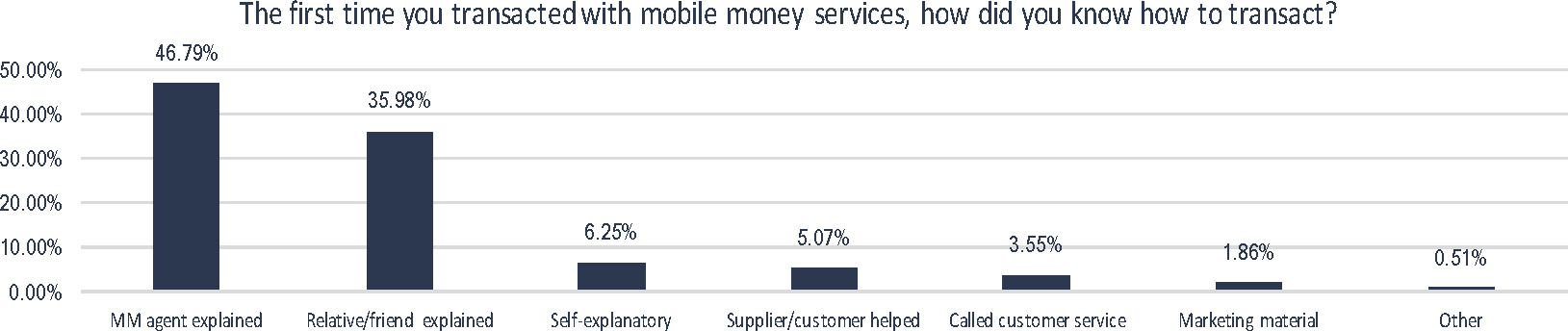

The field surveys included the operationalization of the six-point ethnographic framework, by building off salient issues raised in the FDGs. In the questionnaire, researchers introduced questions on past experiences with banks and informal savings or loan groups to get a sense of people’s perceptions of traditional formal and informal ways of banking. There is a block of questions comparing respondents’ attitudes towards DFS vis-à-vis banks and touching issues of economic hierarchies and self-exclusion. Another module measures the role of social networks in the adoption DFS, explicitly asking respondents to recall the first time they transacted with DFS, and who supported them during the first interaction with the new services. In some cases, questions addressed more than one factor, e.g., networks of belonging and technological appropriation, as the following example shows:

Table 3. Example Question for the Factor ‘Networks of Belonging’

| The first time you transacted with Mobile money services, how did you know how to transact? | 1 | A relative/friend explained how to use mobile money |

| 2 | Mobile Money agent explained it. | |

| 3 | A supplier/customer helped you transact. | |

| 4 | Called a customer service number to get instructions. | |

| 5 | Read marketing materials/explanatory video/print/ radio advert. | |

| 6 | Self-explanatory | |

| 97 | Other (Please specify________________________) |

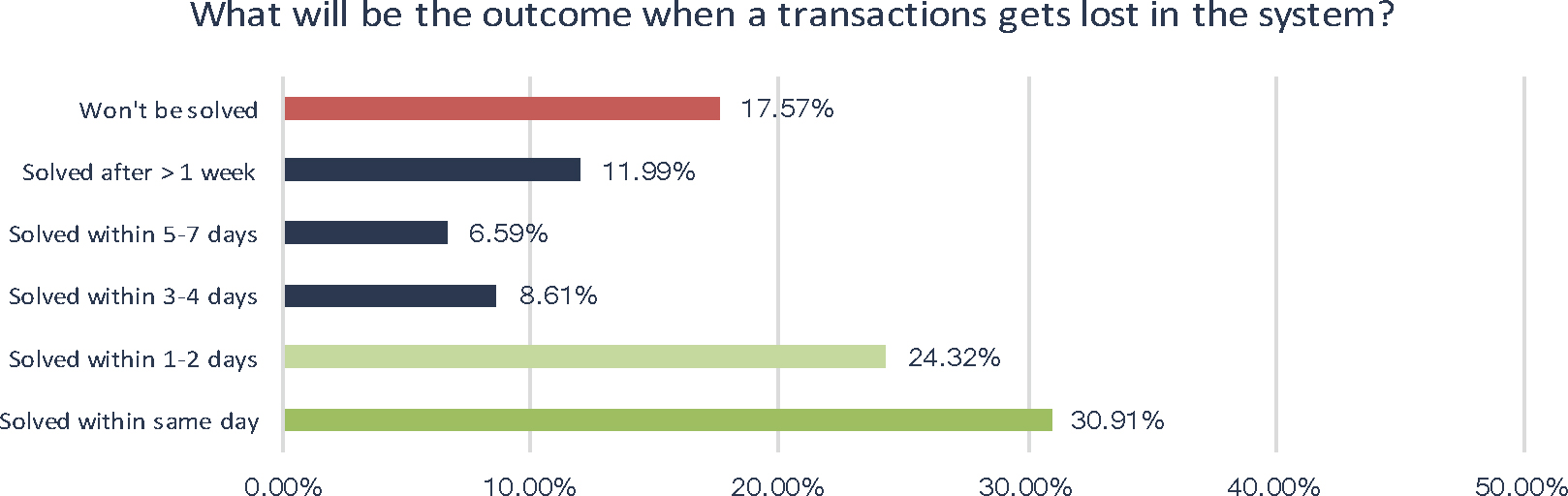

In the survey there are questions measuring the perception of risks consumers may have of agents operating in the streets as well as what would be the outcome if hypothetically the money transacted gets “lost in the system”, one preoccupation respondents expressed in several opportunities during the FGDs.

The survey sample conceived more than 1200 interviews of DFS users. By design, the sample is exclusively focused on MSMEs and individual entrepreneurs that are using DFS. Out of the 1200 interviews planned, about 200 were sampled through a list of intensive DFS users identified through analyzing transaction data performed in the first step. The rest of the customers were randomly selected in commercial areas using a filter questionnaire to ensure the inclusion of active DFS users that regularly use DFS for their businesses.

First predictive modelling was done using initial results of the qualified FGD results combined with hypotheses of what a would-be business’s transactional behavioral pattern might look like (such as higher volumes compared to individuals, or concentrations during normal business hours). The results of the survey then yield ground truth data on whether activity correlates with an actual business or an actual individual. Further, the aggregated results enable refinement by helping to affirm the initial analytic conjectures used to draw expected MSMEs used for the survey, and to help interpret the respective activity patterns in the context of their survey results.

Exploratory Analysis

The first approach to segmenting businesses and individuals is to apply conjectures of what a business behavior might look like to the dataset and see what patterns emerge, and then refine. With a subscriber base exceeding several million accounts and hundreds of millions of individual transactions, the dataset is too big for traditional analysis or to simply look at each individual transaction separately. The approach was to aggregate the data according to some behavioral metrics and then identify statistical thresholds that would indicate abnormal transactional behavior. The underlying hypothesis being that businesses behave characteristically differently, which would anticipate different’ behavior patterns compared to users that use DFS only for personal purposes.

Identifying businesses with a survey or typical qualitative approach at this magnitude would not be feasible and ensure the sample was large enough to achieve a model that is statistically significant. Nearly 3 million surveys would need to be conducted to achieve a significance at the 95% confidence interval. Such a sample is not operationally possible for “in person” interviews, not realistically cost effective and not possible within time constraints.

The data centric segmentation approach allowed the project to get information and data insights to review in weeks instead of months, after which the initial segmentation could be tested against intricate in-country knowledge and operation field experience. These insights were then used for selecting a focused sample of the true positive outcomes of the analysis, instead of a blanket approach in selecting the candidates for the focus group discussions. As the focus group discussion guide included talking points around the ethnographic framework, this helped to weave their DFS perceptions into the patterns emerging from the transactional data analysis. It also presented an opportunity to apply the ethnographic framework to a new market, beyond the four study countries of the original field work, to examine its fit in an additional country context in Africa. In this respect, the framework very much held.

Applying the framework as a lens for interpreting quantitative patterns held as well. The focus group discussions proved the above limitations in the analysis immediately, as there were found that some of the analytical positives were in fact not MSME’s owners but employees in MSMEs. Something that would never have been identified in the data, nor characteristics that the initial conjecture-based could have ever identified independently. This enabled the team to fine tune the survey sampling frame, to eliminate some of the survey candidates within the first questions, as well as during telephonic interviews accelerating the results obtained from the survey. Finally, with the ethnographic framework articulated within the survey instrument, it will also be possible to quantify how the broader market assessment can be characterized in terms of barriers and drivers to uptake and compare quantitative survey results against qualitative assessments established by the focus group data.

The survey results will be used as ground-truth data to validate and tune the analytic segmentation model for identifying who is an MSME from the multi-million user base. Moreover, interpreting these segments in terms of transactional characteristics and themes of DFS perceptions will add depth to segmented groups and propensity scores generated by the predictive model. At a high level, to compare themes of drivers and barriers to uptake between businesses and individuals (and, equally, small business owners who are themselves individuals who hold perceptions about DFS). Within segments, to look at how these themes may compare across micro-small-medium sized enterprise groups; or equally across individual entrepreneurs where users that may, for example, be more regular active users of services might evidence more trust in DFS compared to latent users. Or perhaps to identify if segments that evidence higher levels of churn or dormancy might emphasize specific elements of the framework.

The results of analytic segmentation models are discrete. In this case: business vs non-business users. More nuanced, the models will also aim to segment the size of the business; however, this classification is also discrete: micro, small, or medium. The surveys give these segments “personality” to help give life to these groups. The ethnographic framework helps to understand how perceptions drive trust in digital financial services. The quantified statistics of several million individuals may be imbued with a voice by interpreting transactional patterns through the lens of the survey instruments that have embedded the ethnographic framework.

Preliminary Survey Results

The full survey started in June 2018 and extended until August 2018. Almost 90% of the interviews took place in the commercial city center of the project market. As of mid-July 2018, about 50% of respondent entrepreneurs had been interviewed. Slightly more than half of the businesses in the sample were formal and registered.

For businesses, the main reasons to start using mobile money were convenient pricing and speed of services. The survey further collected information regarding each of the factors pertaining to the Ethnographic Analytical Framework.

Historical Roots of Monetary Transactions

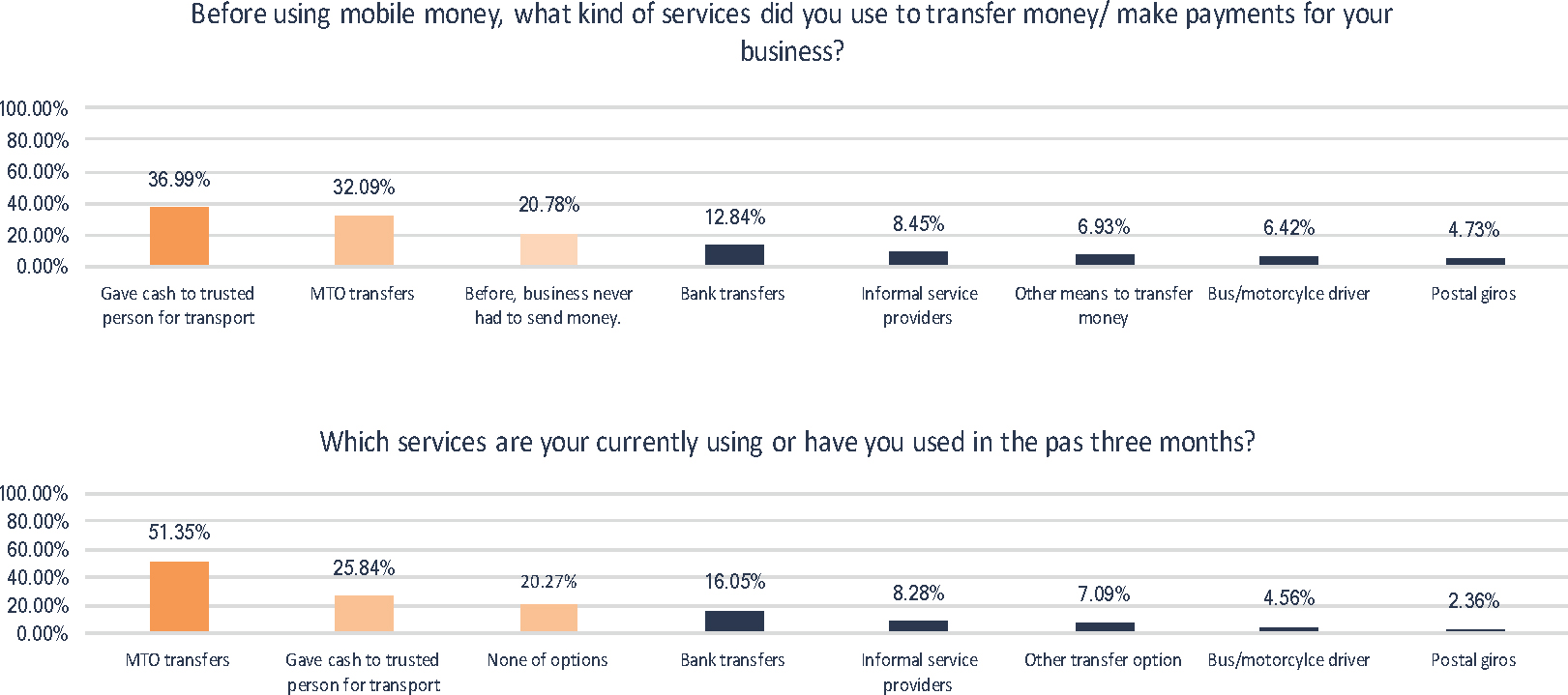

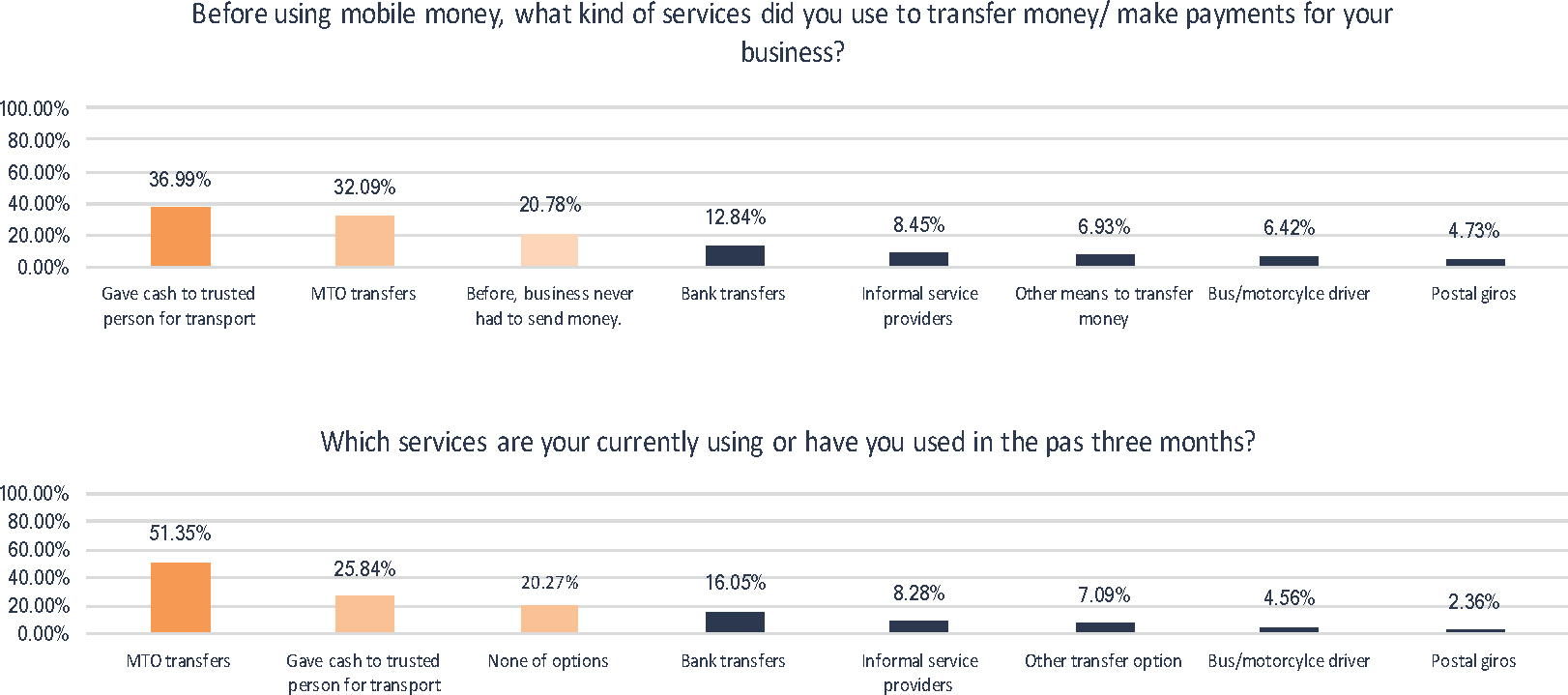

In the past, people trusted intermediaries to send or receive money. Respondents recall that, before using mobile money as their most preferred way of transferring money, they relied on money transfer services or trusted persons who travelled long distances with cash.

Most of the respondents in the sample are experienced mobile money users, more than half of them have been using mobile money for more than 3 years already. When mobile money services are used cash transfers via trusted person become less frequent. However, as anticipated during the FGDs, the latter is still a prevalent practice, and this reliance on social networks can work as a barrier to grow trust in DFS. Familiarity with remittances can help customers to trust new mobile money services.

Figure 3.

Mobility of People and Money

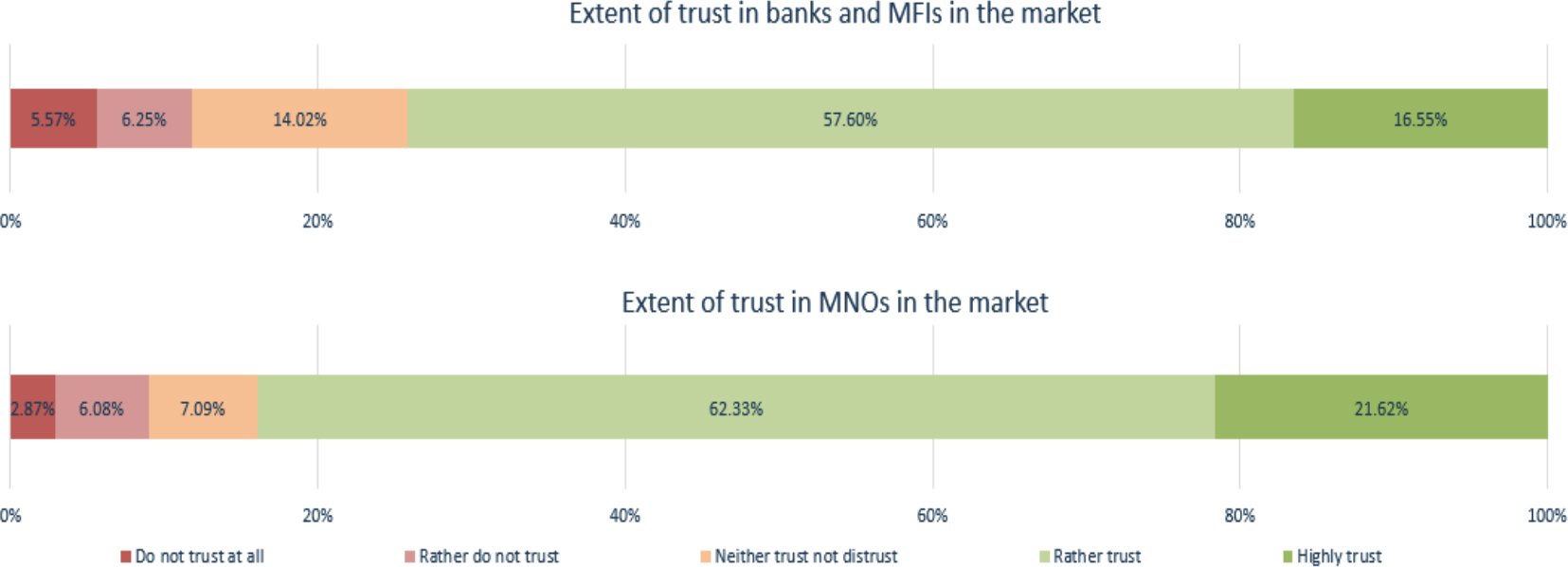

Individual trust in DFS seems correlated with the historical confidence or lack thereof, that they have in banks and financial institutions in the country. In the project’s study country, the level of trust in the ecosystem seems to be high. Hence, the extent of trust respondents have in FSPs is high with about three quarters of respondents that trust or even highly trust Banks and MFIs and even more than 80% of interviewed entrepreneurs trusting or highly trusting MNOs in the country. Trust in the ecosystem underpins trust in new services and works as a driver for their adoption.

Figure 4.

Convenience matters. The most preferred way of transferring money is using MTO services, such as Western Union, showing a shift in users’ preferences when transferring money towards using electronic means such as electronic transfers. This way of transferring money is perceived as more convenient concerning pricing and speed, compared to traditional ways of sending or receiving money.

Local networks and connections with friends, family and neighbors explain most transfers. Among interviewed individuals, domestic transfers are most prevalent when sending and receiving money via mobile money services. When transferring money this way, interviewed entrepreneurs send money above all to family members as well as to friends. Those sending money abroad via mobile money services account for less than 10% of respondents. Recipients of mobile money transfers received money as well in a large majority of the cases from family members and to a smaller extent from friends. Only 13% of the respondents received mobile money transfers from abroad.

As people recognize the need for money and people to move, new digital services can integrate into familiar norms, and work as a driver for the use and adoption of mobile money. As already expressed during the FGDs, those who used mobile money services to make cross-border transactions, already perceived the advantages of mobile money over traditional remittances or courier services.

Figure 5.

Technological Appropriation

It is worth to clarify that the sample was, by design, focused on entrepreneurs. More than half of them work in registered companies and in the formal sector. Therefore, respondents may have a higher level of education and technological savviness than the average DFS user in the country. Almost 80% of interviewed entrepreneurs use the Internet. 95% of them access it at home or at work (in more than 70% of the cases), and almost all of them on a smart phone that they own.

The uptake of DFS is strongly linked to experiences with technology and knowledge how to use it, as well as the fears on how the new technology will develop in the future and how it may change social norms and habits.

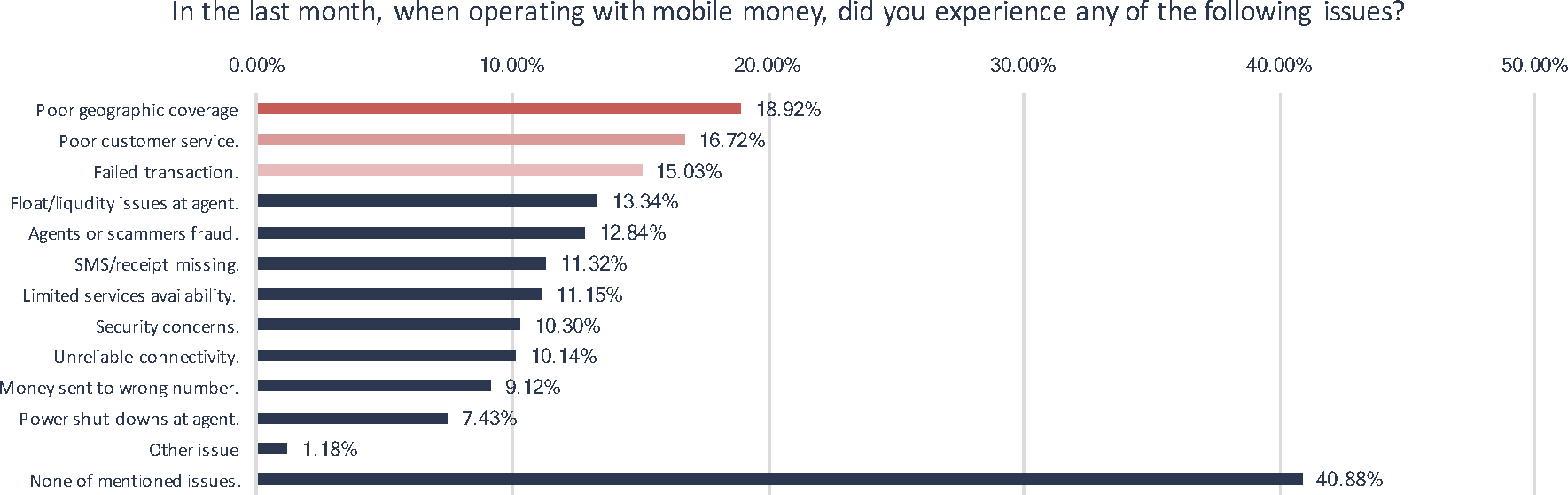

The experience with new technology, how it works, and the fears of changes brought about by technological advances, can work as either a driver or a barrier to embracing digital financial services. During the survey, about two fifth of users explained that in the past month they had not experienced any issues when using mobile money.

The top 3 challenges experienced with the use of mobile money services were poor geographic coverage; poor customer services, and; failing transactions. Hence, poor infrastructure (poor geographic coverage; power shutdowns at agents) or unreliable technology (failed transactions; missing SMS/ receipts) are affecting users’ experiences. Other difficulties that respondents are experiencing are the lack of float or liquidity at agents which result in poor customer experience and reputational risks for providers of digital financial services.

The self-perception on the level of understanding of mobile money services seems to be high among respondents, as two thirds of them Disagreed or Strongly Disagreed that “Mobile money services are difficult to understand.” Moreover, almost three quarters of entrepreneurs Agreed or Strongly Agreed that “mobile money adverts/ marketing materials clearly explain how to activate your account.” This perception was already anticipated during the FGDs and differs from what has been perceived by users in other countries of the ethnographic study, where adverts were not perceived as clear enough by interviewed users.

Figure 6.

Figure 7.

Technological appropriation does not seem to be a barrier for interviewed entrepreneurs to adopt and use mobile money. Mobile money marketing material is mostly perceived as clear and understandable giving instructions on how to set up mobile money; how to do transactions, and; how to react when transactions fail.

Perceptions of Risk and Customer Protection

The data indicates that only about a third of respondents believe that “mobile money services are not safe” (Agree/Strongly Agree with the statement). Further, 22% of respondents state that they or one of their family members lost money while saving. Surprisingly, the largest proportion (one third) of affected persons lost money with a mobile money provider. About 20% lost savings with a savings group or when saving with a friend. Despite the high percentage who claimed having lost savings with mobile money providers, this fact does not seem to affect respondents level of distrust towards these services. Only slightly more than 10% of respondents in the sample have respectively experienced fraud or scams within the last month or have security concerns when using agents.

Not only trust, but also customer expectations are high. Data collected during the survey on risks perceptions align with the apprehension of the security risks that can affect mobile money technology and platforms to be perceived as a barrier for their adoption and usage. Compared to other countries, users’ skepticism towards DFS is lower. If money gets lost in the system, more than half of respondents believe the issue will be solved in less than 2 days. This trust in the system could also be related to the fact adverts are perceived as clear and as providing enough information to successfully use mobile money.

Figure 8.

Networks of Belonging

Digital Financial Services can challenge existing social norms and identities, especially regarding the security and sense of belonging provided by semiformal credit clubs or savings groups. In that respect, slightly more than half of informants believe that using mobile money agents means less privacy.

While agents remain the most important contact when interacting for the first time with mobile money services, about a third of respondents learned about how to transact for the first time from friends or family members. During the focus groups, interviewees stated word of mouth references or reference from friends, colleague and family as a key driver for uptake. This is relevant, firstly, because users seem to value human interaction and identity groups when trying to understand and adopt new technologies, and; secondly, because networks of belonging are extremely relevant factor in the decision-making of users of mobile money.

Figure 9.

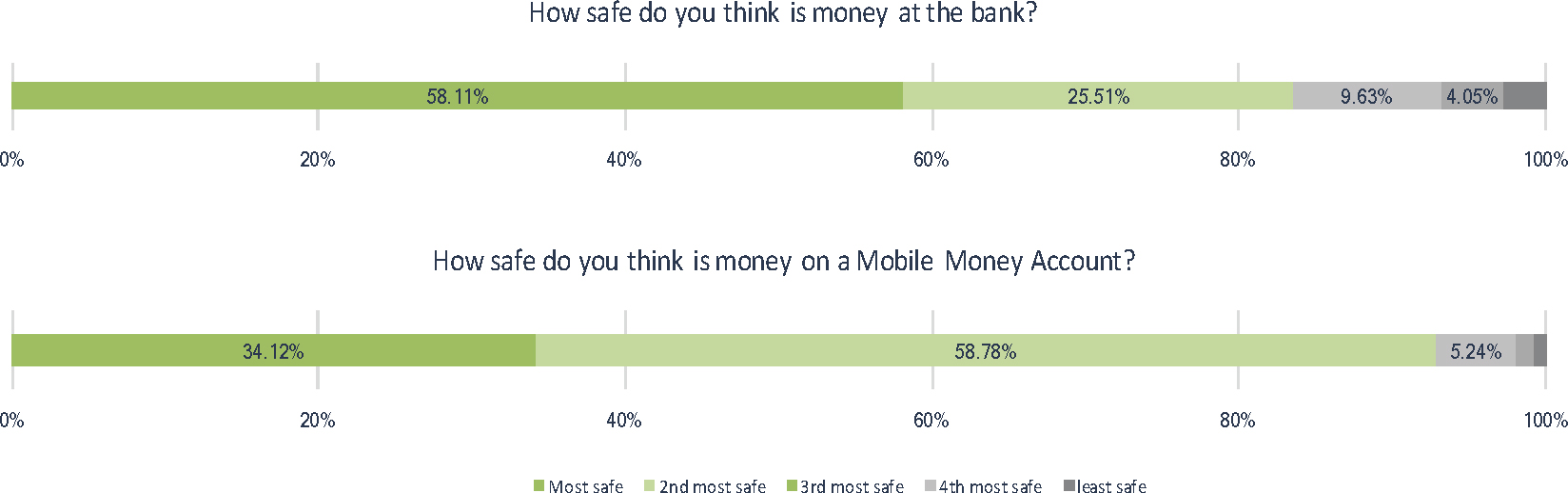

While trust in networks of belonging and word of mouth are pivotal for uptake of new financial services, perceptions of trust towards established financial institutions matter as well. It was found that while many interviewed entrepreneurs would use mobile money for transfers, they would turn to established structures for savings, such as banks. 58% of the respondents stated that the safest place to save is a bank, whereas 34% of interviewed individuals believe the safest place to keep money is a mobile money account. The least safe places to save money are saving with friends and with family members.

Figure 10.

Figure 11.

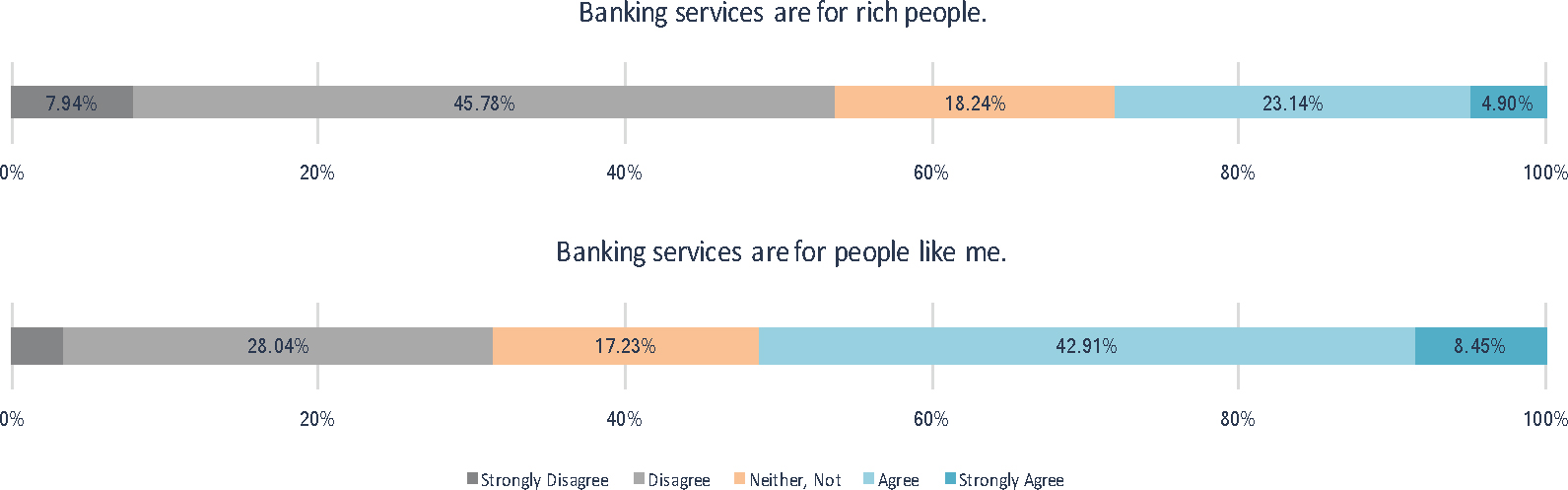

Economic Hierarchies

DFS have the potential to provide users a more accessible and affordable option to be financially included. Survey results show that over 54% of entrepreneurs disagreed or strongly disagreed with the idea that banking services are for rich people. Indeed, they perceived that banking services are for people like them. More than half of them agreed or strongly agreed with this statement. In this case, respondents exclude themselves through their perceptions, but they don’t ‘feel’ self-excluded from formal financial system as in other countries of the study. This might be due to the fact that the project surveyed entrepreneurs only, which may also have higher income levels than the average mobile money user.

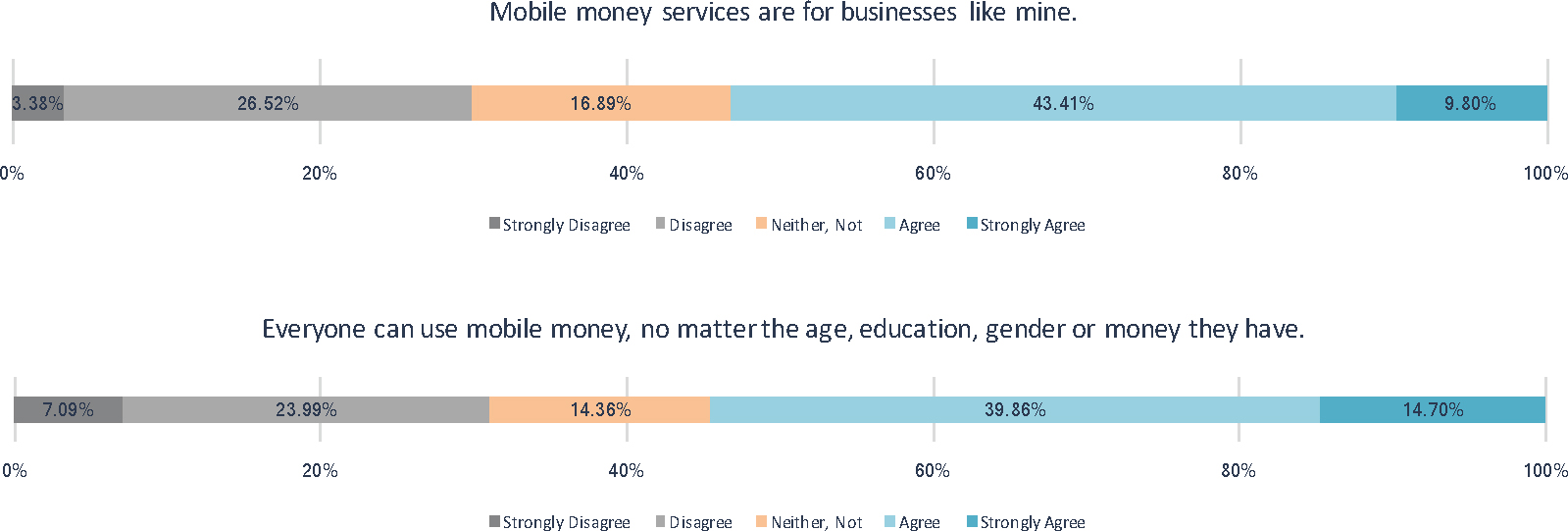

Findings do not suggest that mobile money is disrupting economic hierarchies at a systemic level. Trust in mobile money services is confirmed and they position as an alternative to traditional banks. More than half of respondents agreed or strongly agreed that mobile money services are meant for business like theirs. Mobile money is perceived as a non-discriminative option to transfer money. Almost 55% of the respondents characterized them this way (see following chart).

Figure 12.

Quantifying Socio-Cultural Drivers and Barriers

The next step in the analysis is to quantify the extent to which the six themes of the framework present a driver or barrier for the survey participants to trust and use DFS in our country of interest. To this effect, the project created indices for every theme, where each factor index draws on the set of constituent survey questions. Six indices are designed, each of them as an aggregate combined measure from several variables defining the respective themes.

For this first attempt to quantify the framework, no weights are assigned to the variables that are combined to indices, neither are indices weighed differently in the overall framework. We stress this point, as one of the immediate take-aways of this approach and in comparing previous qualitative synthesis is that individual survey questions could belie “big” or “small” motivators for individuals that should be weighted accordingly when developing the index. This observation also amplifies the ongoing need for some qualitative research (such as focus groups) since it’s critical to understand if a target market segment might find issues like network reliability, for example, as a ‘really big’ barrier to uptake versus a minor nuisance that a prospective user just needs to live with if they take-up the service.

All indices are normalized so that their values all range between 0 and 1. This makes the indices comparable across the factors of the framework and facilitates interpretation.

- Index values closer to 1 indicate that the respective factor constitutes a driver of trust in and use of DFS;

- whereas lower values, closer to 0, indicate that the factor is a barrier that can prevent growth of trust in DFS in the given context.

- When values are higher than 0.4 but lower 0.6 we consider them as neutral, meaning that the factor in question is neither a driver nor a barrier.

These gradients help to highlight how factors are positively or negatively influencing the trust and use of DFS for the sample of interviewed respondents, despite the absence of weights.

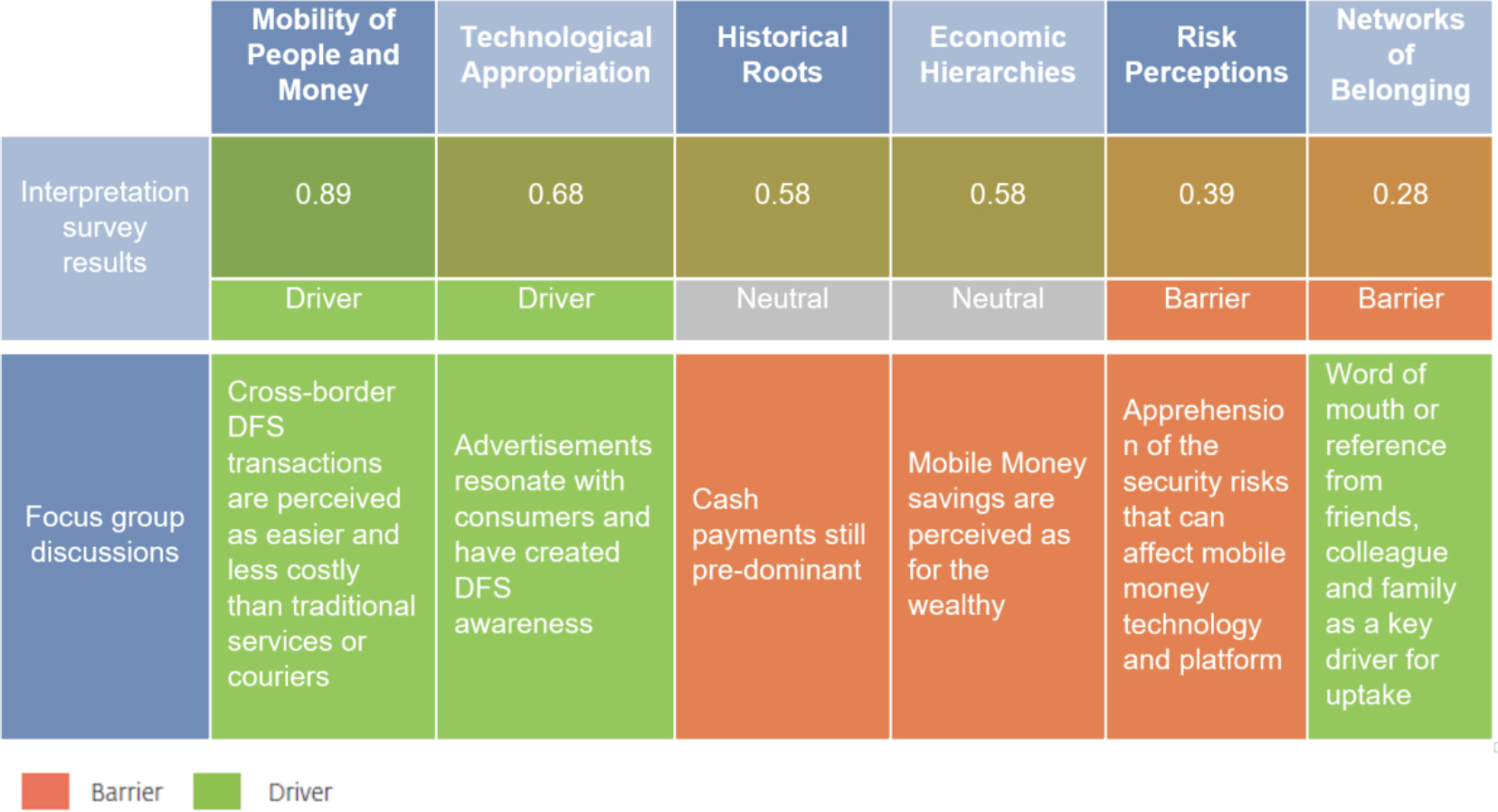

Table 4 shows the index values we calculate based on survey data and compares them to the findings across factors that came out of the focus group discussions.

For the main drivers, both FGDs and survey results point out in the same direction: mobility of people and money. In this case, the quantitative analysis provides a better understanding of the importance of this factor, which is the strongest driver (score = 0.89) for the uptake of digital financial services such as mobile money.

Albeit to a lesser extent, with a resulting score of 0.68, technological appropriation also qualifies as a driver towards trusting mobile money. During the FGDs participants highlighted their perceptions on advertisements, valuing them as clear and successful in creating awareness on mobile money. The survey asked more detailed questions regarding ownership of devices (feature phones, computers, smart phones, etc.) as well as understanding of how devices and new technologies work. This distinction was acknowledged when building the index. The finding is also interesting when compared to the original ethnographic study, where the technological appropriation factor tended to be a strong barrier across most segments. Whereas in this case, targeting businesses owners, it is clear that they are more technologically savvy; delivering technology-based services is a driver for uptake – as seen through both the qualitative and quantitative lens, and therefore different than what might be expected when engaging more general consumer market segments.

Table 4. Quantitative Results vis-à-vis Qualitative Results from FGDs

In the case of historical roots of monetary transactions, the effects appear to be more neutral than the focus groups would suggest. Variables capturing the trust in banks, microfinance institutions and mobile networks operators were taken into consideration to create the index. During the focus group discussions, the participants expressed that cash payments were still predominant. When these perceptions are compared with the results obtained after the survey, it seems to be that the prevalence of the cash culture is not as strong as initially inferred during the FGDs. The factor shows a neutral (score=0.58) influence in trust towards new mobile financial technologies. This also presents an interesting comparison given the survey’s focus on business owners. Payments are a two-way street: while the businesses themselves might have a more neutral outlook to technology-driven payment services, it must be remembered that it is individual consumers who are coming into shops to buy goods and services. The interplay of broader cultural attitudes toward trust in financial services generally is therefore likely to play a factor (possibly barrier) when considering payments, even if businesses owners may be more neutral (or favorable) on this factor.

A second set of factors initially categorized as barriers are related to economic hierarchies: defined as neither a clear driver nor a clear barrier (neutral) given an index score of 0.58. While focus group discussions convey that mobile money savings are perceived as exclusive to the wealthy, and thus constitute a barrier for uptake, the index would moderate these conclusions – just as in the case of the historical roots.

By contrast, perception of risk and consumer protection is a clearer barrier to trust in mobile money (score=0.39). On one hand, during the focus groups, participants expressed apprehension towards the security risks that can affect mobile money technology and platforms. On the other hand, the survey results show that having lost savings with mobile money providers does not prevent mobile money users from using the services. With that respect, this case shows that it is important to introduce weights in the indices, and to assess the relative relevance that different user experiences have in forming perceptions about risk.

The strongest barrier for trusting mobile money (score=0.28) is that of networks of belonging. The corresponding index is a measure of the intensity and diversity in the use of mobile money as a way of understanding the density of networks of belonging and its influence in trust in mobile money. During the focus group discussions, participants pointed out that closest kin’s opinions (such as those of relatives, friends or colleagues) act as a strong driver for using mobile money. At the same time, in the survey, it was found that people prefer institutions for saving their money, instead of trusting their networks of belonging (see page 22). The divergence equally raises questions as to whether the survey is adequately capturing cultural issues that pertain to this factor as well. This presents a clear area for more considered refinement of the survey instrument.

This is only a first attempt to quantify the extent to which factors of the framework constitute either drivers or barriers for DFS. The work is subject to ongoing revisions and future iterations and adaptations may still change the exact calculations of indices and therefore also the resulting scores for framework factors. Potential modifications such as dropping or adding variables to the calculation of individual indices or the introduction of weights are part of ongoing discussions.

Nevertheless, these preliminary results and the contrast between results of qualitative and quantitative analysis illustrate the value of combining ethnographic and quantitative approaches to complement each other, allowing to show nuances of peoples’ subjectivities. Their general alignment with qualitative analysis is encouraging, and the ability to view factors in terms of gradients highlights value in its own right. That factors can be more clearly deemed ‘neutral’ is a prominent modification of the analysis, as well as the ability to rank factors from high-to-low, as they’re presented in table 4.

Challenges and Lessons Learned From Combining Ethnographic and Empirical Research Approaches

The described research work is the first attempt to apply and operationalize the ethnographic framework for identifying and describing drivers and barriers of mobile financial services in a quantitative survey. Bringing ethnographic and quantitative empirical research approaches together allows new insights and gives a structured way to capture the context of DFS usage and adoption in a country. However, combining these different approaches also requires overcoming challenges.

Convincing stakeholders that are not familiar with ethnographic research about the added value of applying the framework to an analysis can be one challenge. Good communication and showing for example the use cases and operational value of using the framework to a provider can help overcome preconceptions. In this case, the FSP did not question the usefulness of integrating questions that are related to the ethnographic framework into the survey questionnaire. On the opposite, the company was eager to learn more about the differences in the level of trust in financial services offered by different types of financial institutions (MNOs, banks, MFIs, etc.). The project client also provided inputs and suggested the inclusion of additional questions to understand better what digital financial services customers value, how they perceive and use these services and what their considerations are behind behaving in a certain way. The framework was therefore positively received and validated as a way to help test customer appetite for new products.

Another challenge is selecting the right questions for each dimension of the ethnographic framework to capture the essence of that dimension through only a limited number of quantitative questions. Questions should be kept to the necessary minimum to not make the survey and interviews longer than they need to be. Precisely capturing qualitative concepts such as trust and risk perception in a quantitative survey is not easy. In addition, there is no one set of questions that will work for each survey. Finding the right questions for documenting personal and individual information such as perceptions and attitudes towards mobile financial services is highly dependent on the content of a study as well as the country context and the culture of communication.

No one set of questions fits all purposes. Nevertheless, a potential next step for operationalizing the ethnographic framework is to define guidance and lists off potential questions for each dimension of the framework to give researchers in the future a pool of ideas and questions to choose from and to adapt for different contexts in order to capture the drivers and barriers of digital financial services. Such guidance can build on our first experiences and insights from applying the framework by refining and generalizing questions we used for this study, by adding additional questions as well as by exploring more ways to apply them (such as asking respondents if they agree with statements, letting them rank different aspects, directly asking them about concepts or using show cards and images and capturing reactions).

CONCLUSION

We find that it is possible to translate findings of ethnographic research into tangible results that inform deepening financial inclusion and changing mindsets on the use and applicability of ethnographic methods to address business needs. This project contributed to changing mindsets across arenas: in the industry, the DFS provider we collaborated with used it for better segmentation of its customer base; among donors; and internally at IFC. Ultimately, the research has made DFS user and non- user voices more audible, helping to crystalize issues that typical users face in terms of narratives that providers can apply to their service offering.

Applying qualitative research findings to articulate high level market insights around potential customer uptake and usage is challenging. As this report identifies, it is simply not possible to apply methods based on individual engagements, interviews or thick ethnographic description to a potential customer base of millions. Yet, a high level finding of the original ethnographic study demonstrates the value of understanding how complex and nuanced socio-cultural norms deeply drive perceptions, emotions and attitudes about core elements of digital financial services, such as technology, money, and social trust. For providers, scaling these services to reach new market segments and achieve better financial inclusion requires understanding what may drive or inhibit individuals in these targeted market segments to trust the service and entrust their money to it.

This paper identifies the value of using the ethnographic approach to identify these factors of trust drivers and barriers within societies and articulates a six-point framework for probing these issues. It identifies the challenge of extrapolating “thick description” to generalized insights for broader market segments and outlines an approach to meet this challenge by using this framework to design focus group discussions and survey instruments. Furthermore, the framework provides a lens to qualitatively interpret focus group discussions in a coherent and consistent manner (Table 2). Structured surveys provide a quantified understanding of trust factors in the targeted market segment of small business owners (Table 4). Ultimately, this approach provides a consistent and structured way to categorize and aggregate people’s perceptions in a way that provides actionable business intelligence.

We also see this in our case study in an emerging DFS market. The operational project’s focus on business owners and entrepreneurs provides an opportunity to look at a synthesis of drivers and barriers of that specific group, while also permitting a structured comparison to market segments more generally. As merchant services speak to the interplay between buyer and seller, an ability to structurally compare issues that are salient (whether driver or barrier for one group or the other) to these respective groups and to assess possible alignments or divergences should also help to anticipate issues for developing merchant-specific services.

The approach brings its own set of challenges, such as efficiently selecting the minimum number of key questions to understand the issue, without overwhelming survey respondents. Or, in interpreting survey responses, how to index the magnitude of an issue (i.e., do responds feel very strongly about an issue that is a ‘big’ driver or barrier versus a ‘small’ one). Refining survey instruments and structuring interpretation is part of next steps for ongoing research as the research team aims to develop a more formalized tool. The results to-date, as presented herein, show promise, with the ability to meaningfully segment and interpret socio-cultural trust perceptions. Comparing Tables 2 and 4 illustrate how the ethnographic framework can provide a consistent lens for both qualitative and quantitative interpretation. Furthermore, this paper articulates how quantified survey results are also being applied to big data analytics to further marry the lens of the ethnographic framework to other datasets.

A further step, after purely analyzing the survey data along the different dimensions of the ethnographic framework, the following step in the analysis process would be to link this data with mobile money transaction data to better understand how customers’ transaction behavior is associated with their perceptions and level of trust in DFS. Linking those data sources allows to explore how individual perceptions about mobile money and the banking system reflects in their use of mobile financial services.

Soren Heitmann is an Operations Officer at the International Finance Corporation (IFC). He leads the Applied Research and Learning (ARL) Program under the Partnership for Financial Inclusion, a joint initiative of IFC and Mastercard Foundation in Sub-Saharan Africa.

Sinja Buri is an Operations Analyst at IFC, based in Dakar, Senegal.

Gisela Davico is a Research Consultant at IFC, based in Washington, DC.

Fabian Reitzug is a Consultant and Carlo Schmid Fellow at IFC, based in Dakar, Senegal.

REFERENCES CITED

Buri, Sinja, Robert Cull, Xavier Giné, Sven Harten, and Soren Heitmann

2018 Banking with Agents: Experimental Evidence from Senegal,” World Bank Policy Research Working Paper, April 2018.

De Bruijn, Mirjam and Inge Butter

2017 An Ethnographic Study on Mobile Money Attitudes, Perceptions and Usages in Cameroon, Congo DRC, Senegal, and Zambia: Final Ethnographic Narrative Report. African Studies Center Leiden, University of Leiden.

Harten, Sven and Soren Heitmann

2014 Find the Gap: Can Big Data help to increase Digital Financial Services Adoption? Field Note 4. The Partnership for Financial Inclusion. December 2014.

Heitmann, Soren, Anna Koblanck, and Gisela Davico

2017 A Sense of Inclusion, An Ethnographic Study of the Perceptions and Attitudes to Digital Financial Services in Sub-Saharan Africa”. The Partnership for Financial Inclusion. November 2017.

IFC

2018 Digital Access: The Future of Financial Inclusion in Sub Saharan Africa. The Partnership for Financial Inclusion. May 2018. Koblanck, Anna, ed.

Ke Liu, Clark

2018 The Role of Micro-Small and Medium Enterprises in Achieving SDGs. Policy Brief, Global Symposium on the Role of Micro-, Small- and Medium- Enterprises (MSMEs) in the achievement of the Sustainable Development Goals (SDGs). United Nations, New York, 2018.